Ohio Should Wean Off Cigarette Tax Revenue and Pursue Healthier Fiscal Policy

Instead of doubling down on a shrinking tax base, Ohio lawmakers should instead look towards tax solutions that secure the state’s long-term fiscal health.

4 min read

Instead of doubling down on a shrinking tax base, Ohio lawmakers should instead look towards tax solutions that secure the state’s long-term fiscal health.

4 min read

New leadership at the FDA will have the opportunity to revisit decisions that have shifted consumption to illicit products and discouraged harm reduction—policies that, however well intended, have come at a significant cost in lives.

7 min read

An update to the EU’s Excise Tax Directive that embraces harm reduction principles would save lives and provide a steady stream of revenue to support public health expenditures.

22 min read

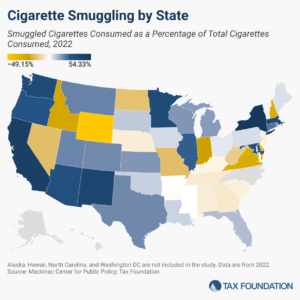

The US already has massive problems with cigarette smuggling. A cigarette prohibition would be devastating to tax coffers while pushing smokers toward what could become the world’s largest illicit market.

4 min read

Tax avoidance is a natural consequence of tax policy. Policymakers should consider the unintended consequences, both to public health and public coffers, of the excise taxes and regulatory regimes for cigarettes and other nicotine products.

5 min read

Growing cigarette tax levels and differentials have made cigarette smuggling both a national problem and a lucrative criminal enterprise.

16 min read

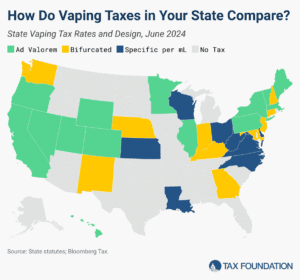

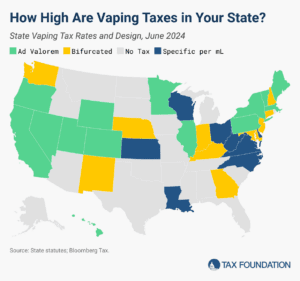

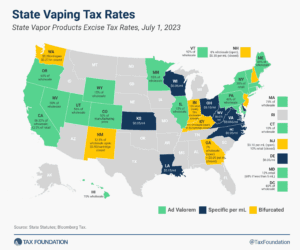

As much as 98 percent of vaping products sold in the US are illicit. Most states levy an excise tax on vaping products, but these tax systems vary substantially. The result is a messy tax system covering largely illicit products, and no one knows whether taxes are being collected and remitted on most products sold nationwide.

7 min read

The vaping industry has grown rapidly in recent decades, becoming a well-established product category and a viable alternative to cigarettes for those trying to quit smoking. US states levy a variety of tax structures on vaping products.

4 min read

Two pieces of tobacco legislation in Michigan have the potential to decrease state tax collections by $320 million per year, deter smokers from switching to less harmful products, and increase illicit trade and crime.

4 min read

Step into the shadows of illicit trade where taxation, incentives, and criminal networks intersect to fuel the lucrative cigarette smuggling market.

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

3 min read

The potential for alternative tobacco products to save lives is clear and well established. The framework described in this paper uses a scientific approach to tax strategy that will both reduce harm and create a reliable revenue stream for public expenditures.

17 min read

Taxation plays a key role in driving illicit trade. People respond to incentives, and sizable price markups for legal cigarettes create incentives for tax avoidance.

4 min read

At least 32 notable tax policy changes recently took effect across 18 states, including alterations to income taxes, payroll taxes, sales and use taxes, property taxes, and excise taxes. See if your state tax code changed.

16 min read

Later this week, the European Union is expected to release a new Tobacco Tax Directive, the first update in more than a decade. Early reports indicate that the EU will propose a significant increase to the existing minimum cigarette tax rates levied across the Union and expand the product categories that are taxed, including a block-wide vaping tax.

7 min read

If the policy goal of taxing cigarettes is to encourage cessation, vapor taxation must be considered a part of that policy design.

4 min read

Although the majority of state tax changes take effect at the start of the calendar year, some are implemented at the beginning of the fiscal year. Fourteen states have notable tax changes taking effect on July 1.

7 min read

Lawmakers in Washington need not revisit their vapor tax. The current tax is levied at an appropriate level and it has the right tax base.

3 min read

A proposal to introduce a wholesale tax on vapor products in Alaska could make switching from combustible tobacco products very expensive for smokers.

4 min read