The White House Budget Highlights the Need to Extend Pro-Growth TCJA Business Tax Provisions

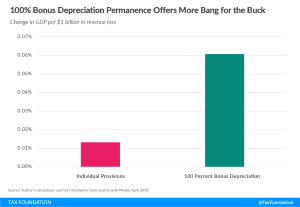

Full expensing, if made permanent, would be one of the most cost-effective ways to increase growth as it would produce about 4.5 times more GDP growth per dollar of revenue than making the law’s individual tax provisions permanent, according to our analysis.

3 min read