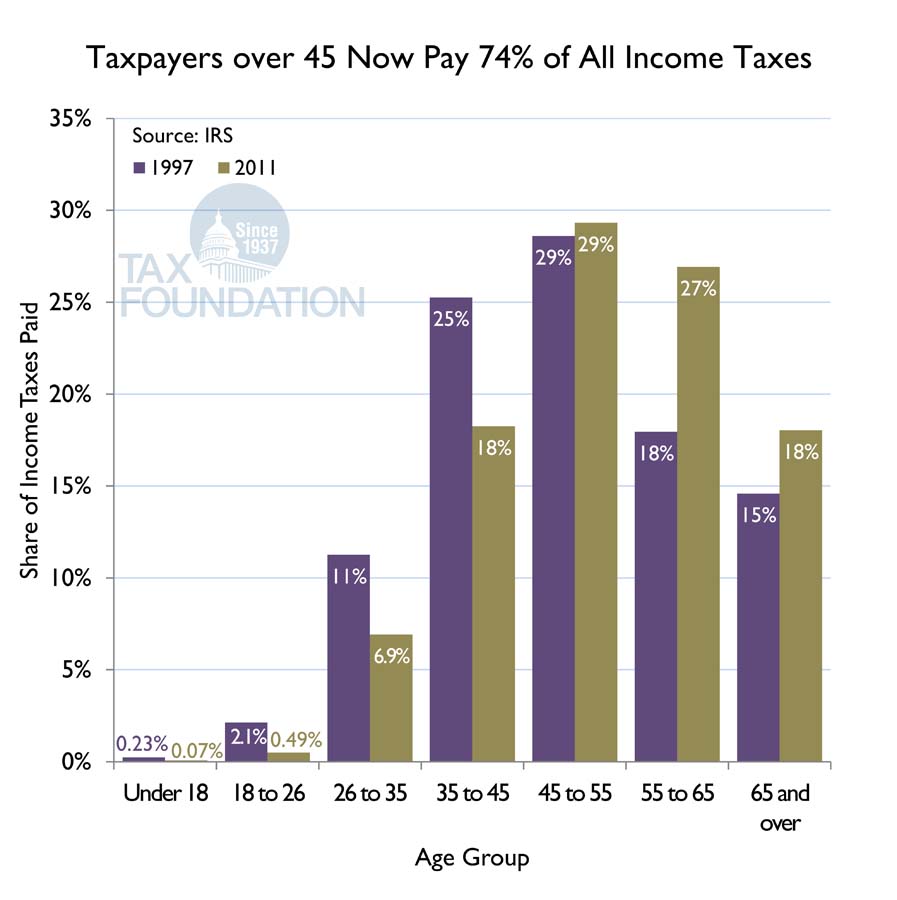

As Americans age, more and more of the tax burden will be borne by older taxpayers. In 1997, 61 percent of all income taxes were paid by taxpayers over age 45. Today, that burden has jumped to 74 percent. The biggest increase has been in the taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. share paid by taxpayers between 55 and 65. In 1997, this group paid 18 percent of all income taxes. Today, they are paying 27 percent of all income taxes. Those over age 65 are now paying nearly one-fifth of all income taxes. Naturally, this raises concerns over the ability of this older generation to save for their own retirement while financing the lion’s share of the cost of government, especially as Washington continues to raise taxes on the “rich” to close rising deficits.

For more charts like the one below, see the second edition of our chart book, Putting a Face on America's Tax Returns.

Share this article