Pro-Growth Tax Reform for Oklahoma, 2025

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min readManish Bhatt is a Senior Policy Analyst with the Center for State Tax Policy at the Tax Foundation.

He holds an LLM in taxation from Georgetown University Law Center, a JD from St. Thomas University College of Law, and a BA from the George Washington University. Prior to joining the Tax Foundation, Manish counseled clients on corporate taxation matters at a Big Four accounting firm, served as a judge advocate in the U.S. Coast Guard, advised several startups, and taught business law as an adjunct faculty member at TCU.

In his free time, Manish enjoys skiing, sailing, and fly fishing with his family.

Lawmakers should finish the work they have begun over the past few decades, tackling tax rates and structures to give the state a leg up in an era of enhanced competition.

84 min read

With property tax bills on the rise, homeowners are searching for answers—and some even want to abolish the tax altogether. In this episode, we break down why property taxes are increasing, common but flawed solutions, and why the property tax remains an economically efficient revenue source.

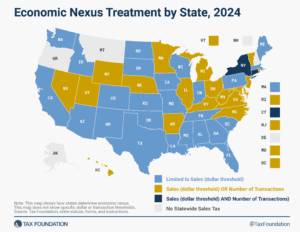

Despite stark competitiveness differences, both New Jersey and Utah share a common goal this legislative session: reforming economic nexus rules that require out-of-state sellers and marketplace facilitators to collect and remit state sales taxes.

4 min read

Lawmakers will enter the 2025 fiscal legislative session with an opportunity to build on the successes of the November special session. Efforts should include addressing the outstanding issues within the corporate and sales tax codes that currently hold the state back.

7 min read

Nationwide, property owners have experienced surges in valuations and are demanding tax relief. Lawmakers are right to find ways to provide it, but should do so with sound tax principles in mind.

5 min read

Taxes are on the ballot this November—not just in the sense that candidates at all levels are offering their visions for tax policy, but also in the literal sense that voters in some states will get to decide important questions about how their states raise revenue.

9 min read

Eliminating the property tax will unfortunately set North Dakota back in significant ways, making the state a national outlier and eroding regional competitiveness.

6 min read

Retail delivery fees are an inefficient and ineffective way to close budget gaps, and lawmakers should consider other, more sound, policy options.

5 min read

Summer has arrived and states are beginning to implement policy changes that were enacted during the legislative session (or are being phased in over time).

13 min read

With proposals to adopt the nation’s highest corporate income tax, second-highest individual income tax, and most aggressive treatment of foreign earnings, as well as to implement an unusually high tax on property transfers, Vermont lawmakers have no shortage of options for raising taxes dramatically.

7 min read

Reforming economic nexus thresholds would not only be better for businesses but for states as well. It is more cost-effective for states to focus on—and simplify—compliance for a reasonable number of sellers than to impose rules that have low compliance and are costly to administer.

4 min read

Vermont lawmakers are considering the adoption of two new taxes on high earners, which proponents have branded “wealth taxes.”

4 min read

Nebraskans need property tax relief and there are sound ways to provide it. However, increasing the sales tax rate to the highest in the country and dramatically increasing cigarette excises is not sound tax policy.

5 min read

Thirty-four states will ring in the new year with notable tax changes, including 15 states cutting individual or corporate income taxes (and some cutting both).

17 min read

The current patchwork of state laws taxing marketplace facilitators is complex, burdensome, and inefficient. States should work to resolve these issues and standardize the otherwise disparate requirements—with or without an inducement from Congress or the courts.

29 min read

Policymakers at all levels of government should avoid the pitfalls of incentives. Instead, they should focus on creating a more efficient, neutral, and structurally sound tax code to the benefit of all types of business investment.

6 min read

Recharacterizing a rather simple repayment transaction as a tax rebate is concerning, not just for sound tax policy, but also for the future of public-private financing partnerships.

4 min read

Montana Policymakers should pursue principled property tax reform that benefits all property owners without creating market distortions or unfairly shifting the tax burden.

5 min read

However well-intended they may be, sales tax holidays remain the same as they always have been—ineffective and inefficient.

4 min read