Kyle Pomerleau is a resident fellow at the American Enterprise Institute (AEI), where he studies federal tax policy.

Before joining AEI, Mr. Pomerleau was chief economist and vice president of economic analysis at the Tax Foundation, where he led the macroeconomic and tax modeling team and wrote on various tax policy topics, including corporate taxation, international tax policy, carbon taxation, and tax reform.

The author of many studies, Mr. Pomerleau has been published in trade publications and policy journals including Tax Notes and the National Tax Journal. He is frequently quoted in major media outlets such as The New York Times, The Wall Street Journal, and The Washington Post. He has also testified before Congress and state legislators.

Mr. Pomerleau has an MPP in economic and social policy from Georgetown University’s McCourt School of Public Policy and a BA in history and political science from the University of Southern Maine.

Latest Work

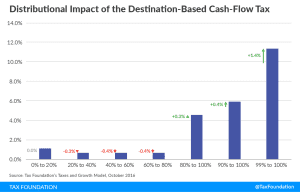

Understanding the House GOP’s Border Adjustment

What is a border adjustment? What are the mechanics of how a border adjustment works, how would one affect U.S. businesses, and what are some pros and cons of enacting one?

29 min read

Exchange Rates and the Border Adjustment

7 min read

2017 Tax Brackets

5 min read

The Estate Tax is Double Taxation

3 min read

Understanding the Candidates’ Tax Plans

12 min read

2016 International Tax Competitiveness Index

12 min read

Should Olympic Prize Money Be Taxed?

2 min read