Texas voters will have the opportunity to decide whether they want to prohibit individual income taxation by constitutional amendment on November 5th.

The autumn vote is scheduled as a result of the state legislature approving House Joint Resolution 38, a legislatively-referred constitutional amendment. Texas’ Senate voted in favor of the amendment 22-9 on Monday, just six hours before a midnight deadline. The House approved the amendment 100-42 on May 9th, securing the two-thirds supermajorities necessary in both chambers.

Governor Greg Abbott (R) championed the amendment to ban the possibility of an income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. . The House Resolution was authored by Republican Representatives Dustin Burrows, Briscoe Cain, Jeff Leach, and Will Metcalf and sponsored by Republican Senator Pat Fallon. Although the majority of “Yea” votes came from Republican lawmakers, the resolution would not have passed without drawing support from some Democrats in both chambers.

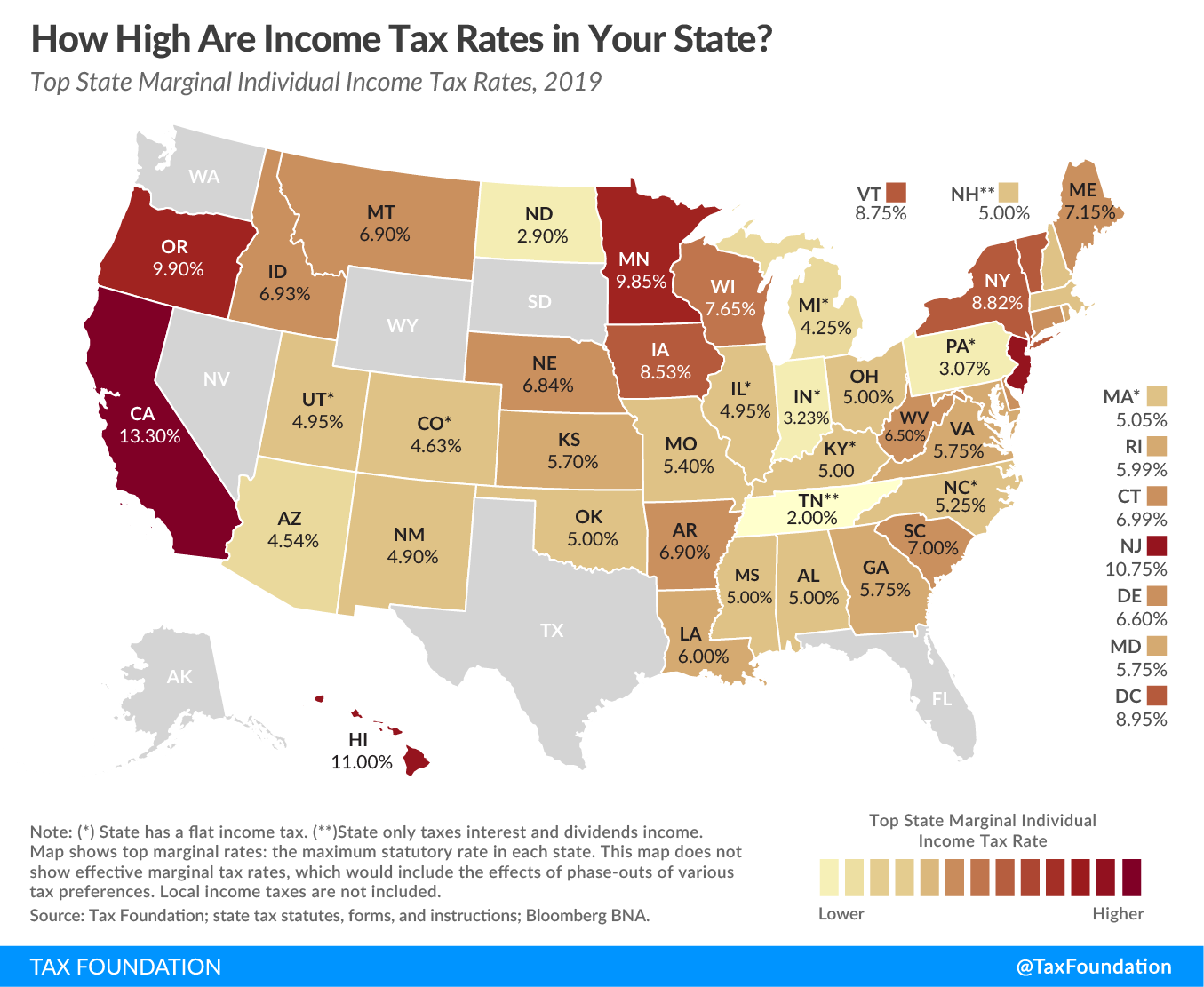

Texas is one of seven states, with Washington, Alaska, Nevada, Wyoming, South Dakota, and Florida, to have no form of individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. . Tennessee currently has no income tax on wage earnings, though it does have a tax on investment income that is scheduled to phase out by 2022. New Hampshire has no income tax on wage income, though the Granite State does impose an income tax of 5 percent on dividend and interest income.

Texas political leaders considered an income tax in the early 1990s as a potential offset to local school taxes. The result was Senate Joint Resolution 49, a 1993 voter-approved constitutional amendment that prohibits a personal income tax without voter approval, and mandates that any revenue from a personal income tax must be dedicated to schools.

However, if HJR 38 is approved by Texas voters on November 5th, then an individual income tax could not be enacted in Texas in any form or for any reason except after a new constitutional amendment. In effect, if voters approve HJR 38, that would erect a new barrier of a two-thirds super-majority in both legislative chambers for there to ever be an individual income tax in Texas for any purpose, whereas the current constitution requires only a simple majority barrier in the legislature before the issue goes to voters.

Texas’ no individual income tax policy is a key pillar of its pro-growth tax code. Texas’ tax structure ranks 15th most competitive in the Tax Foundation’s 2019 State Business Tax Climate Index, which evaluates states based on their overall tax structure. Texas’ strongest component in the Index is its individual income tax. The Lone Star State’s overall tax burden is also relatively low, with the 46th highest state and local tax burden as a portion of state personal income in the most recent Tax Foundation study.

Texas relies more heavily on its sales and property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. for revenues since it does not have an income tax. State and local governments in Texas bring in 35.4 percent of their total revenue from the sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. compared to a 23.6 percent national average, and 43.8 percent of their total revenue from property tax compared to a 31.5 percent national average.

The sales tax is a key source of revenue for Texas’ state government. The sales tax targets current consumption for taxation, making it relatively economically neutral. On the other hand, an income tax creates a disincentive for additional labor and is levied upon current and future consumption, given that it hits earnings that would be used for either immediate consumption or saved for future consumption. This makes the income tax less economically neutral than a sales tax and more harmful to growth.

If approved by voters, HJR 38 would lock in a key advantage of the Texas tax code. The Texas legislature can build upon this competitive advantage in the future by phasing out the state’s Margin Tax, a gross receipts-style tax levied on business revenues. Such a restructuring would make the Texas tax code far more competitive and efficient for Texas businesses, and thereby improve Texas’ ranking in the Tax Foundation’s Index.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe