The Impact of BEPS 1.0

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

The global landscape of international corporate taxation is undergoing significant transformations as jurisdictions grapple with the difficulty of defining and apportioning corporate income for the purposes of tax.

22 min read

EU Member States should seek to minimize the rate and broaden the base of electricity duties, consolidating their rates to the required minimum rate.

3 min read

Portugal’s personal income tax system levies high tax rates on an unusually narrow set of high earners, striking a poor balance between earnings incentives and revenue contributions.

4 min read

Focusing on competitiveness, neutrality, and efficient policies to raise revenue would go a long way in increasing economic growth and stabilizing public finances over the long term.

7 min read

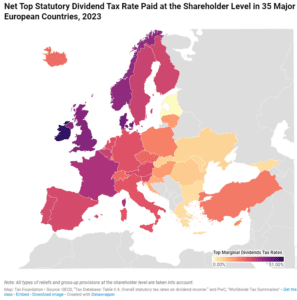

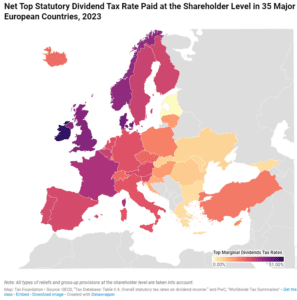

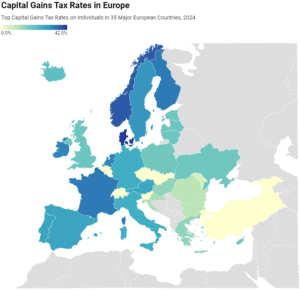

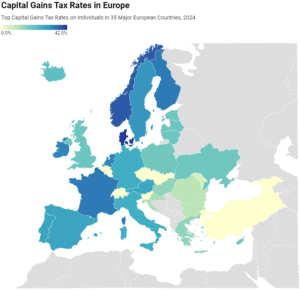

In many countries, corporate profits are subject to two layers of taxation: the corporate income tax at the entity level when the corporation earns income, and the dividend tax or capital gains tax at the individual level when that income is passed to its shareholders as either dividends or capital gains.

2 min read

In many European countries, investment income, such as dividends and capital gains, is taxed at a different rate than wage income.

2 min read

Portugal has the second highest top corporate tax rate in the OECD at 31.5 percent, including multiple top-up taxes. Unlike most OECD countries, Portugal imposes a highly progressive tax structure on corporate income.

6 min read

As the world of tax policy becomes more interconnected, the Tax Foundation is stepping up, recognizing the pressing need for informed and principled tax policy education in an ever-evolving landscape.

Pillar Two, the international global minimum tax agreement, has a considerable chance of failing and may ultimately allow the same problems it was designed to address.

6 min read

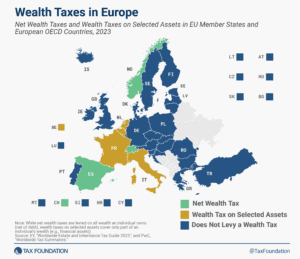

Only three European countries levy a net wealth tax—Norway, Spain, and Switzerland. France and Italy levy wealth taxes on selected assets.

4 min read

Tax-preferred private retirement accounts often have complex rules and limitations. Universal savings accounts could be a simpler alternative—or addition—to many countries’ current system of private retirement savings accounts.

19 min read

The landscape of tax policy is changing—and we at the Tax Foundation are changing with it.

3 min read

Denmark (55.9 percent), France (55.4 percent), and Austria (55 percent) have the highest top statutory personal income tax rates among European OECD countries.

3 min read

Portugal’s value-added tax (VAT) policy is a treasure trove of tax oddities. Thankfully, VAT base broadening is an ideal instrument to give the Portuguese government the fiscal room to implement pro-growth tax reforms

5 min read

A few European countries have made changes to their VAT rates, including the Czech Republic, Estonia, Switzerland, and Turkey.

3 min read

It is essential to understand that the taxation of capital gains places a double tax on corporate income.

5 min read

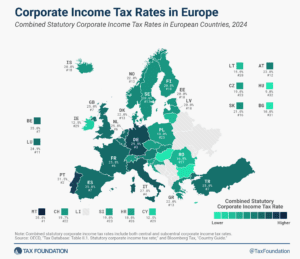

Like most regions around the world, European countries have experienced a decline in corporate income tax rates over the past four decades, but the average corporate income tax rate has leveled off in recent years.

2 min read

In such a determinant semester for Europe, principled tax policy can be an important tool for a more competitive European Union.

5 min read

Spain’s central government could learn some valuable lessons from its regional governments about sound tax policy.

7 min read

In the end, the best way for the EU to support Ukraine’s post-war recovery is to guarantee its tax sovereignty, not just its territorial sovereignty.

5 min read