Unstable Taxes and an Unpredictable Future

When the tax code is stable and predictable, individuals, families, and businesses can set goals for the future and make plans to achieve them.

When the tax code is stable and predictable, individuals, families, and businesses can set goals for the future and make plans to achieve them.

With state tax revenues receding from all-time highs, there’s been a great deal of handwringing about whether states can afford the tax cuts adopted over the past few years. Given that 27 states reduced the rate of a major tax between 2021 and 2023, is there reason for concern?

4 min read

Given that U.S. debt is roughly the size of our annual economic output, policymakers will face many tough fiscal choices in the coming years. The good news is there are policies that both support a larger economy and avoid adding to the debt.

6 min read

Different taxes have different economic effects, so policymakers should always consider how tax revenue is raised and not just how much is raised.

3 min read

Contrary to initial expectations, the pandemic years were good for state and local tax collections, and while the surges of 2021 and 2022 have not continued into calendar year 2023, revenues remain robust in most states and well above pre-pandemic levels even after accounting for inflation.

4 min read

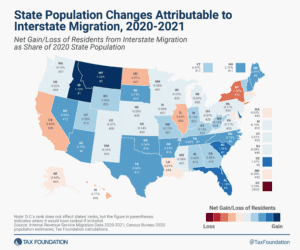

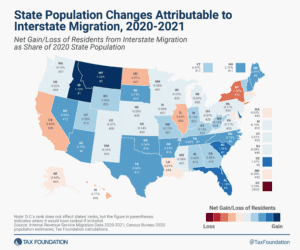

The latest IRS and Census data show that people and businesses favor states with low and structurally sound tax systems, which can impact the state’s economic growth and governmental coffers.

7 min read

Whether tax savings motivated his move or not, the implications for Washington are very real, and serve to illustrate just how dangerous it can be to design tax systems that rely so overwhelmingly on a very small number of taxpayers choosing to stay put.

3 min read

What do The Rolling Stones, NFL star Tyreek Hill, and Maryland millionaires have in common? They all moved because of taxes.

4 min read

If tax increases are included in a package, international experience points toward raising consumption taxes, rationalizing tax expenditures, and broadening the tax base—not hiking income taxes.

6 min read

Responsible pro-growth reforms to Arkansas’s tax code can help ensure that the Natural State is indeed a Land of Opportunity.

9 min read

In recent years, European countries have undertaken a series of tax reforms designed to maintain tax revenue levels while protecting households and businesses from high inflation.

8 min read

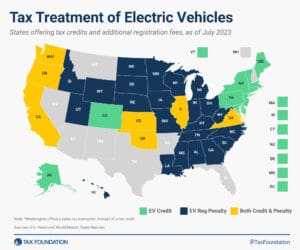

The state EV taxation landscape reflects the evolving transportation sector and the pressing need to address both fiscal gaps in road funding and environmental concerns.

4 min read

Now is the time for lawmakers to focus on long-term fiscal sustainability, as further delay will only make an eventual fiscal reckoning that much harder and more painful. Congressional leaders should follow through on convening a fiscal commission to deal with the long-term budgetary challenges facing the country.

35 min read

Given that wealth taxes collect little revenue and have the potential to disincentivize entrepreneurship and investment, perhaps European countries should repeal them rather than implement one across the continent.

4 min read

What does the tax reform package do well? What does it do poorly? How would it affect me?

4 min read

Lawmakers should focus on simplifying the federal tax code, creating stability, and broadly improving economic incentives. There are incremental steps that can be made on the path to fundamental tax reform.

26 min read

The JCT analysis raises some useful questions for the U.S. domestic debate over Pillar Two. The Treasury Department should examine its support for an agreement that will reduce its own revenue intake. But it is also worth noting that the principal mechanism for the revenue reduction—the foreign tax credit—is a policy already baked into U.S. law, including the Republican-enacted global minimum tax from 2017. The OECD deal merely takes advantage of this longstanding feature.

6 min read

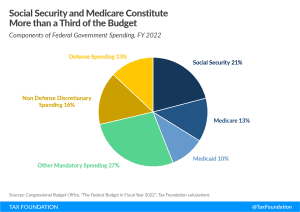

Any serious proposal to tackle the emerging debt and deficit crisis must also address our largest mandatory spending programs: Social Security and Medicare. Together, these two programs will be responsible for nearly 80 percent of the deficit’s rise between 2023 and 2032, according to Congressional Budget Office (CBO) projections.

8 min read

This web tool allows taxpayers to see how cigarette tax revenues have changed since 1955. Across almost all states, a clear pattern of volatility emerges. Tax rate hikes are met with a momentary bump in revenue, followed by a falloff.

2 min read

A better-designed tax system should be a goal of any fiscal consolidation package. That said, our simulations suggest that even substantially higher tax increases are insufficient to curtail long-run debt-to-GDP growth.

14 min read