Download Fiscal Fact No. 298: State Tax Collections Rising in Post-Recession Recovery

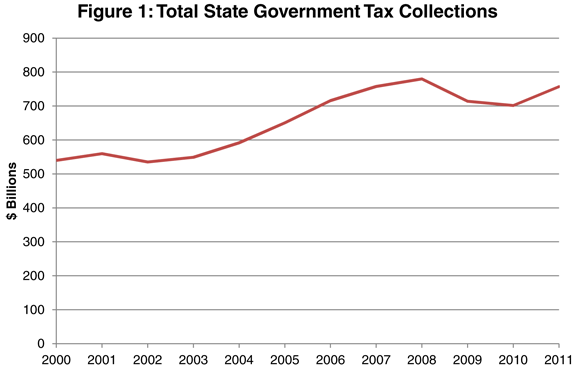

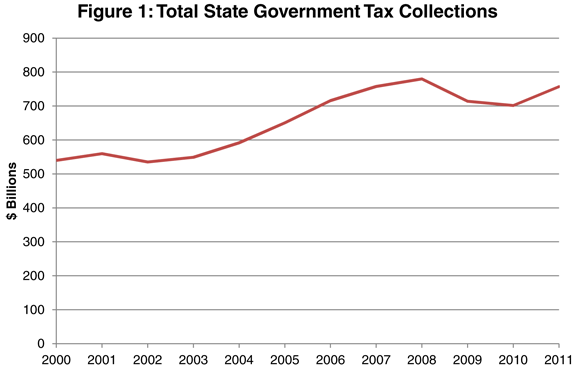

After two years of falling revenue, total state government taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. collections increased by nearly 9 percent during 2011, according to data released by the United States Census Bureau.[1] Total collections were $757 billion last year, [2] still slightly less than 2007 levels prior to the recessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. . Figure 1 below shows state government tax collections since fiscal year 2000. Total collections have increased by approximately 40 percent in nominal terms over this time period.

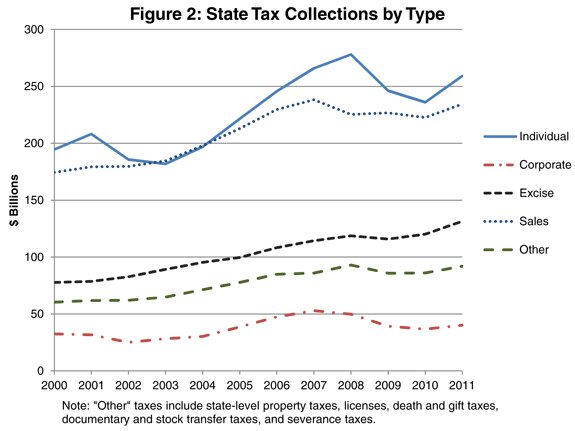

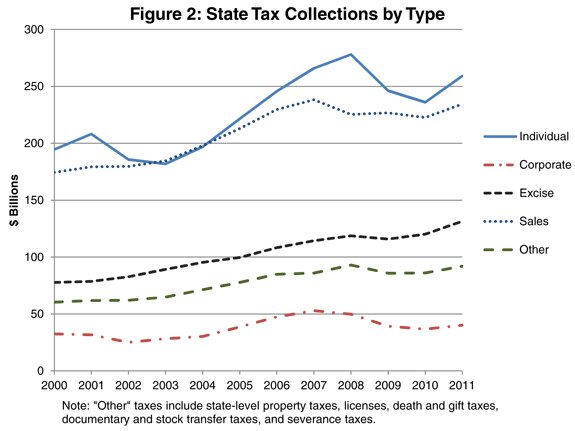

All major types of state taxes saw increased collections in 2011, as seen in Figure 2. Individual income and corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. collections had the largest increases, increasing by 9.8 and 9.4 percent, respectively. Although 7 states (Alaska, Florida, Nevada, South Dakota, Texas, Washington, and Wyoming) do not levy an individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. , [3] these collections accounted for the largest proportion of total state collections nationwide: 34.2 percent in 2011. Sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. es were the next largest, making up 31 percent of the total. Excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. es alone brought in over $131 million for state governments, amounting to 17.4 percent of their total tax collections. Corporate income accounted for a mere 5.3 percent, with smaller taxes composing the remaining total.

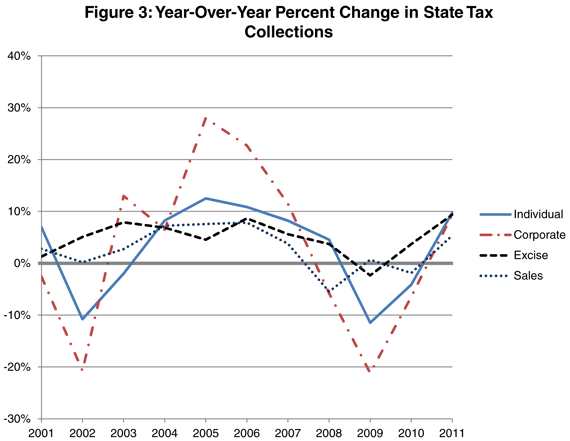

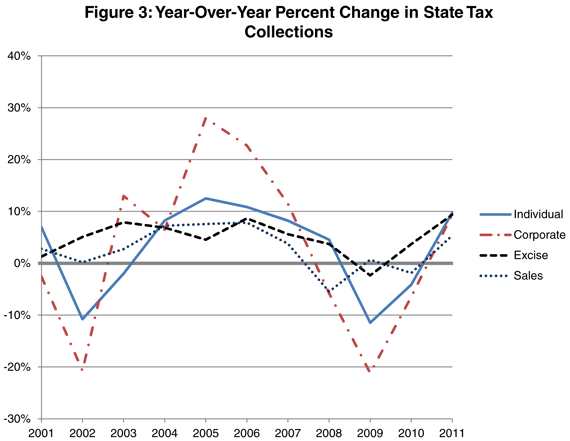

While the recession caused a drop in state tax revenues across the board, some tax sources were more volatile than others. Examining percent changes in tax collections since 2000, it is clear that revenue from state corporate income taxes has by far been the most volatile over the last decade. This is largely due to the fact that taxable corporate incomes are highly dependent on the health of the economy. Individual income tax exhibited significant volatility over the last decade as well. Sales and excise taxes were more stable, though they were still subject to year over year declines during the recession. It ultimately remains to be seen where tax collection growth rates will stabilize as the economy continues to recover.

1. Rudy Telles, Sheila O’Sullivan, & Jesse Willhide, State Government Tax Collections Summary Report: 2011, United States Census Bureau, Governments Division Brief G11-STC, http://www2.census.gov/govs/statetax/2011stcreport.pdf.

2. This data was updated on April 17, 2012 and is available at http://www.census.gov/newsroom/releases/archives/governments/cb12-62.html.

3. In addition, Tennessee and New Hampshire do not tax wage income but do tax capital gains and dividends.

Share