This week brings one decade to a close and opens the next: the 2020s. The equivalent decade a hundred years prior saw the prohibition of alcohol and the birth of speakeasies. While it’s hard to say whether these new ’20s will be roaring with a comeback of bobbed haircuts, art deco, and the Charleston, two things are for sure: wine, beer, and other spirits are legal in the United States, and the champagne you toast with on New Year’s Eve will be taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. ed.

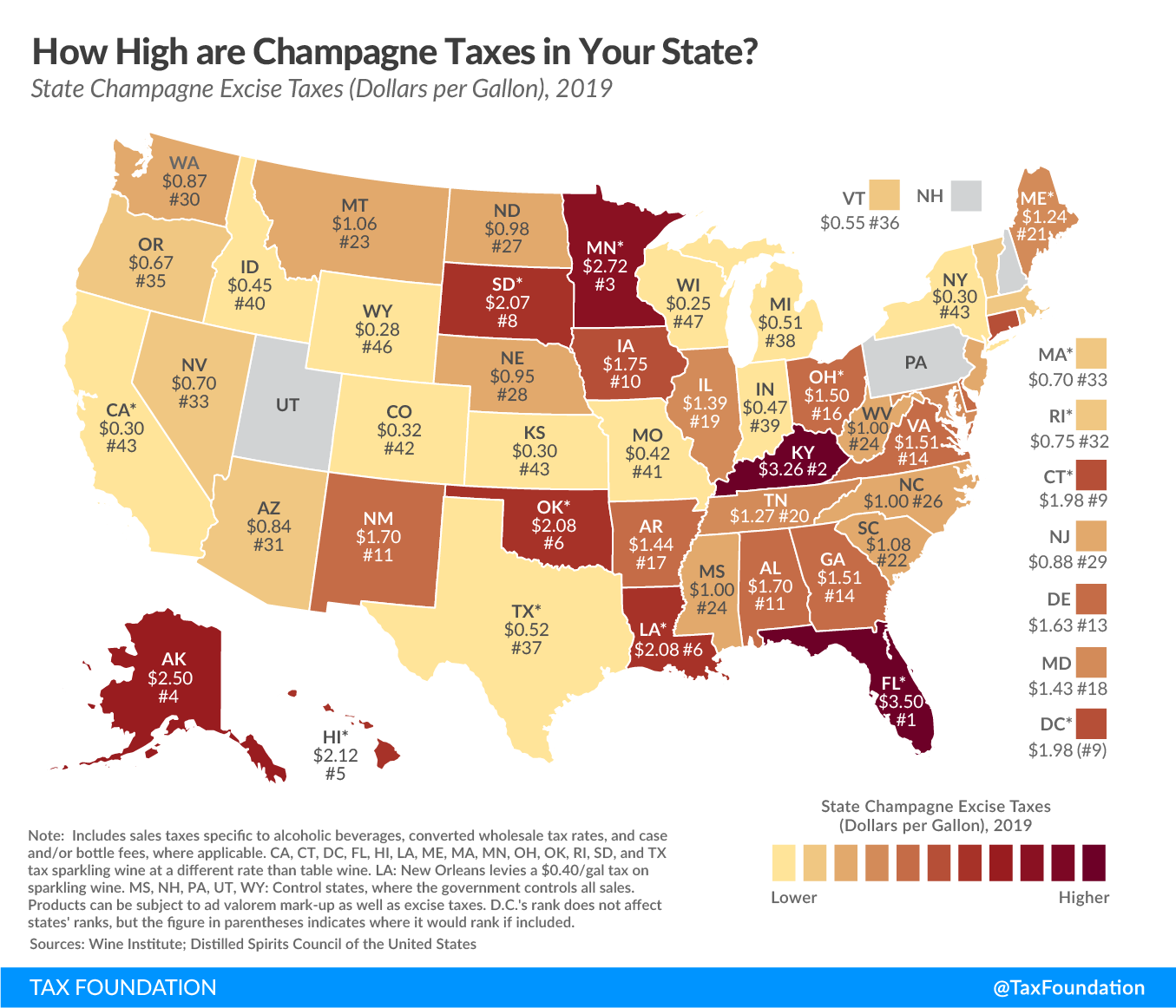

According to data compiled from both the Wine Institute and the Distilled Spirits Council of the United States, Florida comes in with the highest state champagne tax rate at $3.50 per gallon. Next come Kentucky ($3.26 a gallon) and Minnesota ($2.72 a gallon). Wisconsin ($0.25) and Wyoming ($0.28) are at the other end of the spectrum, with New York close behind at $0.30 a gallon.

Most states use the same excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. rates for champagne and table wine, but 14 have higher, alternate rates for sparkling wine.

Even though states can levy taxes at the production, wholesale, or retail level, vendors ultimately pass along those taxes to consumers in the form of higher prices. On the other hand, four states (Arkansas, Maryland, Minnesota, and South Dakota) and the District of Columbia levy sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. es specific to alcoholic beverages that consumers pay directly.

As you pop open your bottle of bubbly on New Year’s Eve before the ball drops in New York City, take a look at how your state compares on champagne excise taxes.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe