Legalization of recreational marijuana at the state level and how to taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. it: Examples from Colorado and California.

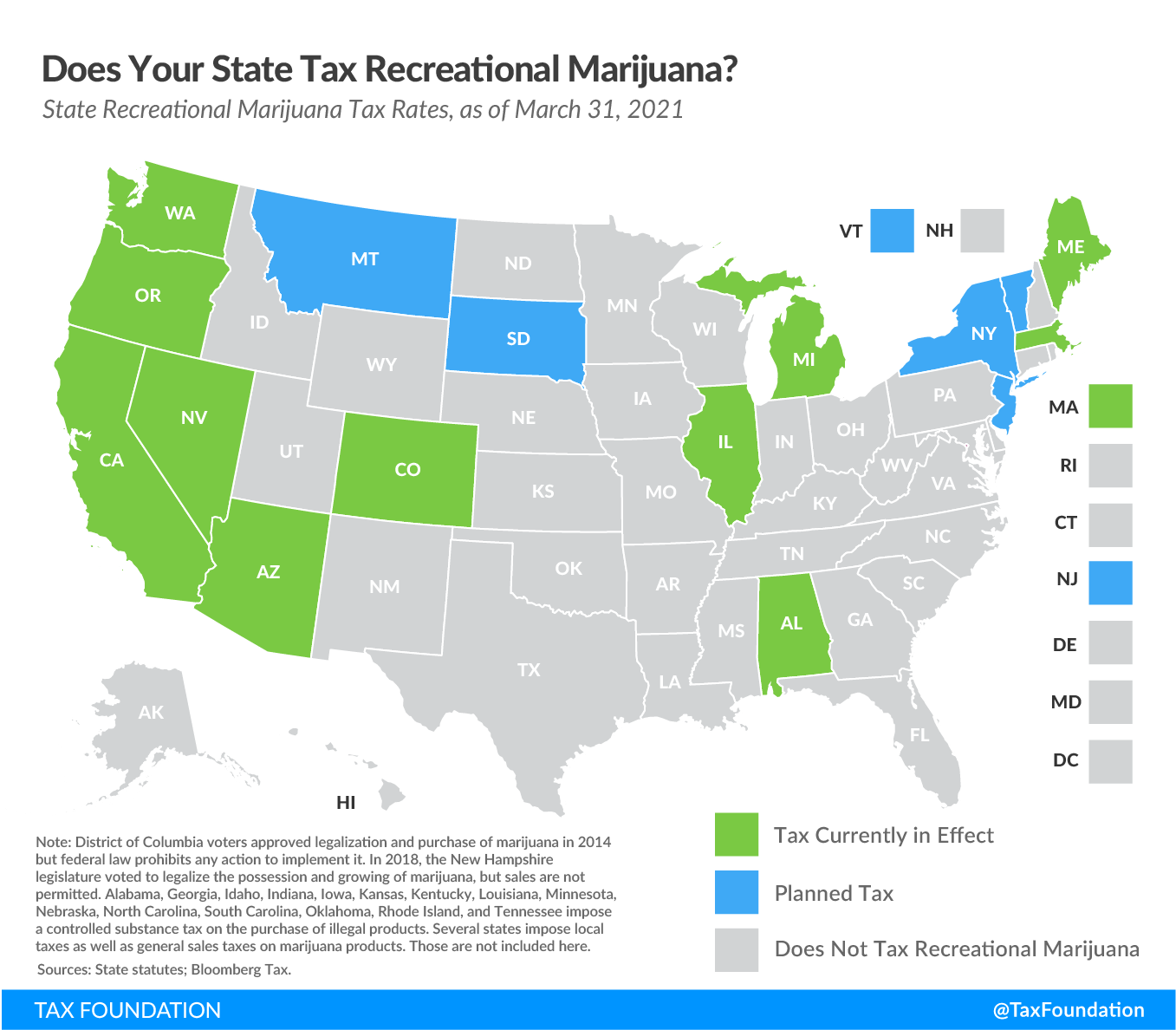

Since 1970, marijuana has been classified a Schedule I controlled substance by the U.S. federal government. Despite this, voters and/or legislatures in 19 states and Washington, D.C. have voted to legalize growing, processing, selling, or consuming recreational marijuana for adults over 21 years of age.

More states are contemplating the tradeoffs associated with legalizing recreational marijuana and taxing it to obtain a new stream of revenue. In fact, a key point when legalizing recreational marijuana is tax design. Most states that currently allow and tax sales have opted for a price-based (ad valorem) excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. and levy the general sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. on recreational marijuana sales.

Problems and Considerations

Some states have seen relative success in legalization, while others have struggled to integrate the new industry into communities, business practices, current legislative code, and taxation.

There are various options for taxing recreational marijuana. Some are best for government revenue, and some for small and new businesses and consumers. Some states have implemented multiple layers of tax and some collect only at the final point of transaction. The difference in approach in legal states makes a direct comparison among current policies difficult.

There are still many unknowns when it comes to the taxation of recreational marijuana, but as more states open legal marketplaces and more research is done to understand the externalities of consumption, more data will become available.

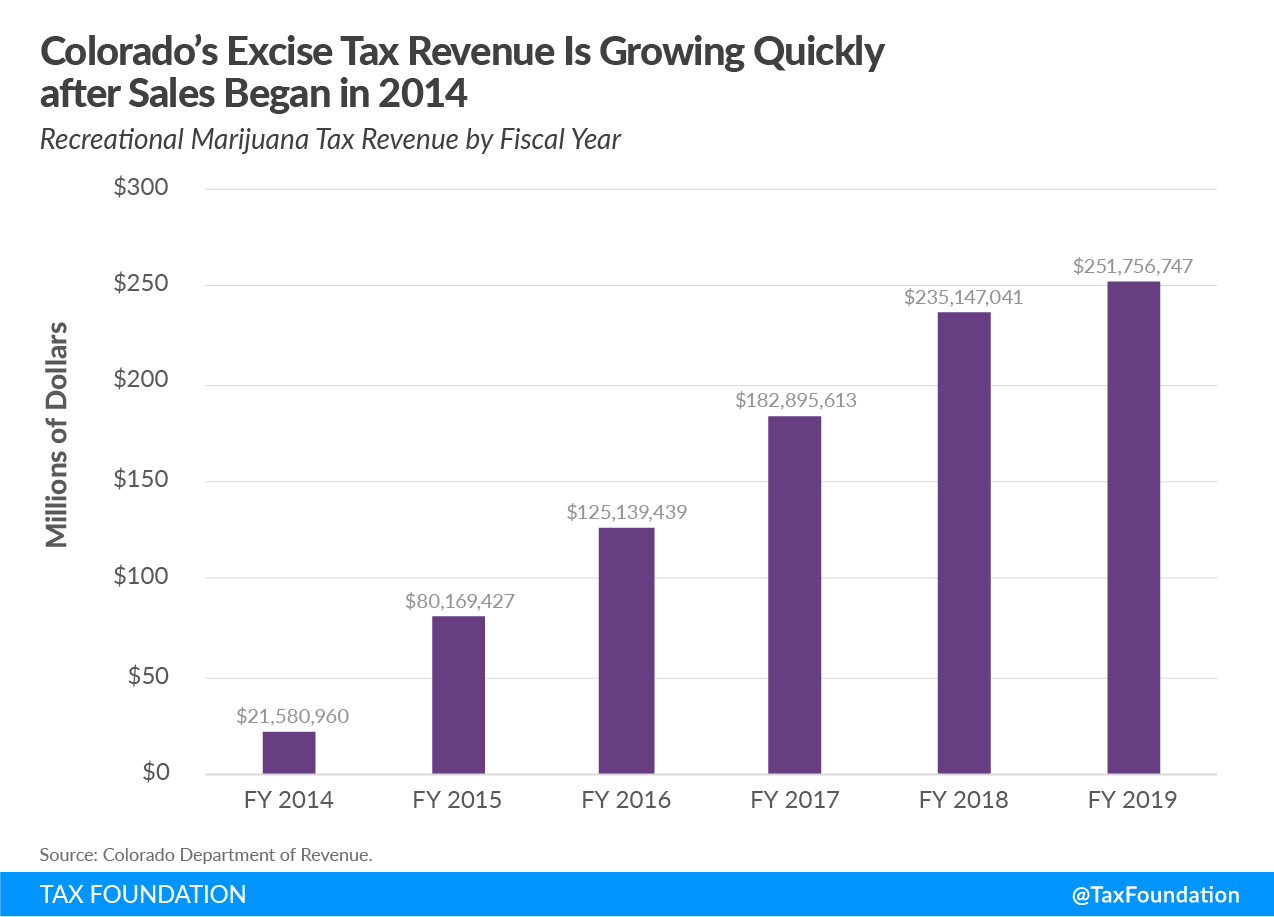

Colorado

Colorado voted to legalize recreational marijuana in 2012, permitting use by adults over 21 years old. The following year, a proposition was approved that allowed the state to levy an excise tax of up to 15 percent on unprocessed retail marijuana (based on Average Market Rate) and a retail sales tax of 10 percent. Retail sales of cannabis were also taxed under the general sales tax, but the product was exempt and the excise tax rate at retail was changed to 15 percent in 2017, despite the retail sales tax on most goods being 2.9 percent. The marijuana retail excise tax is levied on the consumer, while the cultivator excise tax is levied on the grower (cultivator).

The revenues from excise taxes are allocated to different areas of the budget. Retail tax revenue is split among various areas of the budget:

| Marijuana Tax Cash Fund | 64.67% |

| General Fund | 14.00% |

| State Public School Fund | 11.33% |

| Local Governments | 10.00% |

All revenue from the cultivator excise tax goes to the Building Excellent Schools Today (BEST) Fund, to finance costs of repairs and upkeep of public schools.

California

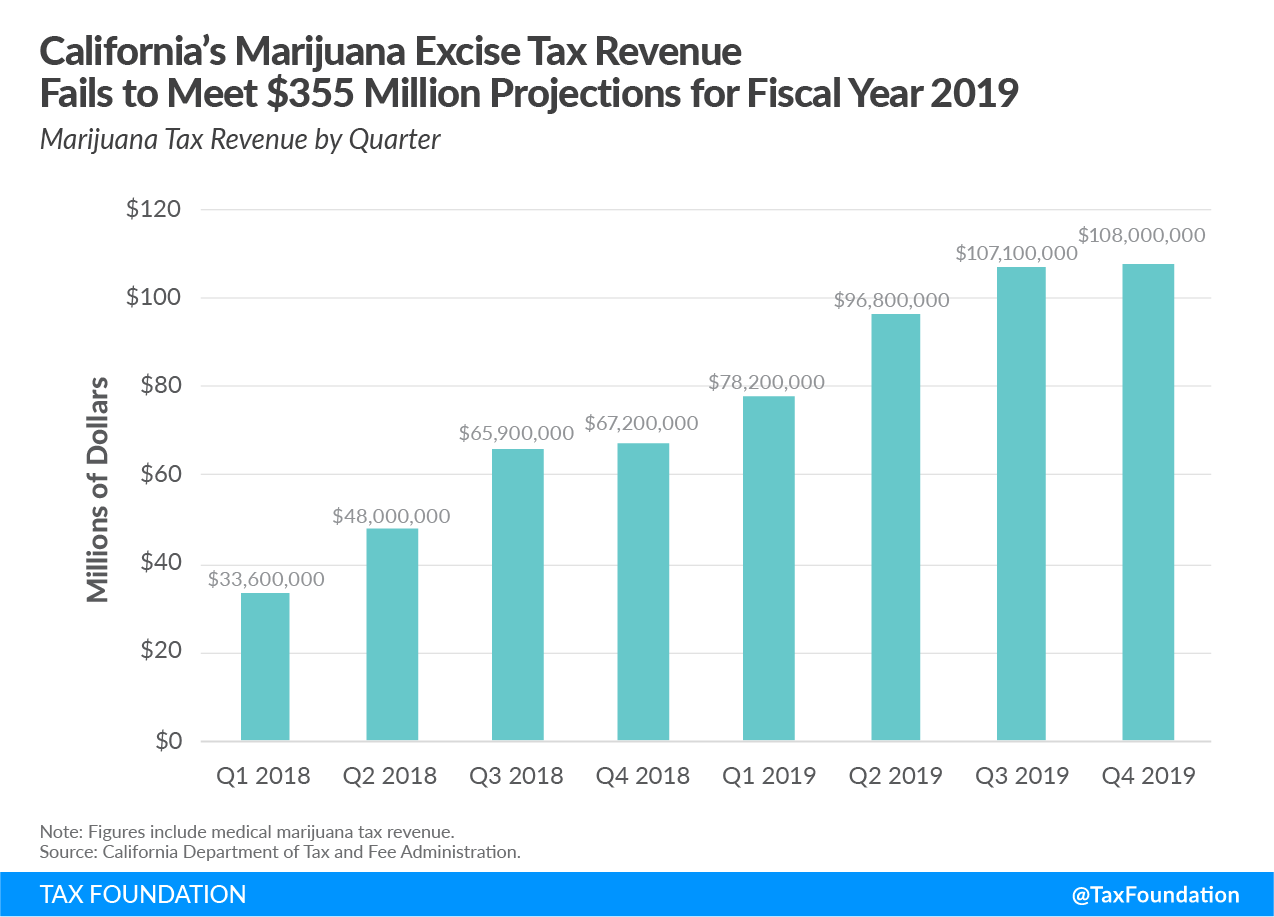

California legalized the sale and use of recreational marijuana in 2016, which went into effect in January 2018. The reform has had mixed success in the state: according to one study, illicit sales still outnumber licensed sales three to one.

The state levies a cultivation tax based on weight and category, a 15 percent excise tax on wholesalers and distributors, and the state retail sales tax of 7.25 percent. Localities levy local sales taxes of up to 1 percent, and a multitude of other business taxes.

By way of example, in Los Angeles, cannabis businesses are taxed according to this schedule:

| Business Type | Rate |

|---|---|

| Sales | 10% of gross receipts |

| Transportation | 1% of gross receipts |

| Testing | 1% of gross receipts |

| Cultivation | 2% of gross receipts |

| Miscellaneous | 2% of gross receipts |

| Source: Los Angeles Office of Finance, Cannabis Tax Rate Table, https://finance.lacity.org/cannabis-tax-rate-table. | |

Levying taxes at every level of the supply chain results in tax pyramidingTax pyramiding occurs when the same final good or service is taxed multiple times along the production process. This yields vastly different effective tax rates depending on the length of the supply chain and disproportionately harms low-margin firms. Gross receipts taxes are a prime example of tax pyramiding in action. , which easily drives up effective tax rates above 45 percent and increases the complexity of the tax code. It becomes increasingly difficult for taxpayers to understand how much they are paying in taxes when several layers of government implement several layers of taxation throughout the supply chain.

The state tax is also rather complicated. The 15 percent cannabis retail excise tax is levied at the wholesale level, resulting in the California Department of Tax and Fee Administration (CDTFA) calculating an Average Market Price (AMP) value by marking up the wholesale value by 80 percent. This means that marijuana worth $100 at wholesale will be taxed at 15 percent at the AMP value of $180. The markup rate increased due to inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. as of January 2020.

| Youth Anti-Drug Programs | 60.00% |

| Environmental Programs | 20.00% |

| Public Safety Grants | 20.00% |

| *Revenue after allocation to regulatory costs and research | |

Summary of Policies

Complicated and burdensome tax structures and rates make it difficult for new, small, and especially minority-operated-and-owned businesses to open or remain open.

While both Colorado and California have multiple layers of tax, the magnitude of the taxes in California result in significant tax pyramiding, and an environment where it can be more profitable to sell and more affordable to purchase in the illicit market.

This may explain why California’s projections for marijuana tax revenue were not met. The tax system contributed to an environment where it became too difficult for licensed businesses to compete with illicit operations.

Conversely, Colorado operates with a relatively simple and less burdensome system for taxing recreational marijuana. This has better accommodated the legal market and allowed tax revenues to grow.

However, in both states, the taxation of recreational marijuana does not adequately meet the principles of sound tax policy: simplicity, transparency, neutrality, and stability.

| Colorado | California | |

|---|---|---|

| Simplicity | ✔️ | ❌ |

| Transparency | ✔️ | ❌ |

| Neutrality | ❌ | ❌ |

| Stability | ❌ | ❌ |

Further Reading

Below are some resources regarding recreational marijuana legalization and taxation from Tax Foundation and other sources. Please conduct additional research on the case prior to discussion.

- A Road Map to Recreational Marijuana Taxation

- How High Are Taxes on Recreational Marijuana in Your State?

- Which States Have the Highest Taxes on Marijuana?

- Several States Considering Legal Recreational Marijuana

- New Jersey May Be the First State Without an Excise Tax Levy on Recreational Marijuana

- Excise Tax Application and Trends

- State Taxation of Cannabis

Reflect on the following questions:

- What is the problem(s)?

- How do these policies meet (or not meet) the Principles of Sound Tax Policy?

- What general options are available to develop more sound policy?

- Who are the stakeholders and what are their interests?

- How has this problem been addressed in other states?