Erica York is Senior Economist and Research Director with Tax Foundation’s Center for Federal Tax Policy. She previously worked as an auditor at a large community bank in Kansas and interned at Tax Foundation’s Center for State Tax Policy.

Her analysis has been featured in The Wall Street Journal, The Washington Post, Politico, and other national and international media outlets. She holds a master’s degree in Economics from Wichita State University and an undergraduate degree in Business Administration and Economics from Sterling (KS) College, where she is currently an adjunct professor. Erica lives in Kansas with her husband and their two children.

Latest Work

Updated Proposal for Year-End Tax Bill

2 min read

The Economic and Distributional Impact of the Trump Administration’s Tariff Actions

The Trump administration has imposed $42 billion worth of new taxes on Americans by levying tariffs on thousands of products. Outstanding threats to impose further tariffs mean additional tax increases up to $129 billion.

8 min read

Family Provisions in the New Tax Code

22 min read

Permanence for Alcohol Excise Tax Reforms

14 min read

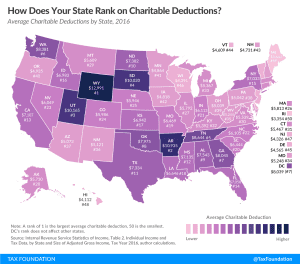

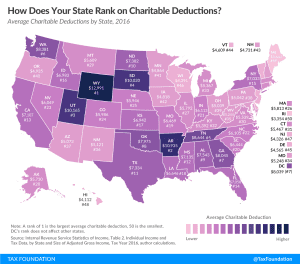

Nearly 90 Percent of Taxpayers Are Projected to Take the TCJA’s Expanded Standard Deduction

The Tax Cuts and Jobs Act simplified tax filings via an expanded standard deduction, but currently, these individual tax changes are to expire after 2025.

2 min read

The Economics of Stock Buybacks

Stock buybacks are readily visible, and unfortunately some have misunderstood stock buybacks to be taking place at the expense of long-term investments.

17 min read

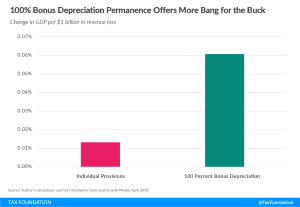

Cost Recovery Treatment Short of Full Expensing Creates A Drag on Economic Growth

Full expensing is a key driver of future economic growth, and can have a larger pro-growth effect per dollar of revenue forgone than cutting tax rates.

3 min read

Permanence for 100 Percent Bonus Depreciation Provides More Cost-Effective Growth than Permanence for Individual Provisions

In the long run, permanent full expensing produces about 4.5 times more GDP growth per dollar of revenue than making individual TCJA provisions permanent.

2 min read