Key Findings

- State revenue stabilization funds, often called rainy day funds, are better funded now than they were at the start of the Great RecessionA recession is a significant and sustained decline in the economy. Typically, a recession lasts longer than six months, but recovery from a recession can take a few years. and can be a valuable tool as states face a sharp pandemic-linked economic contraction.

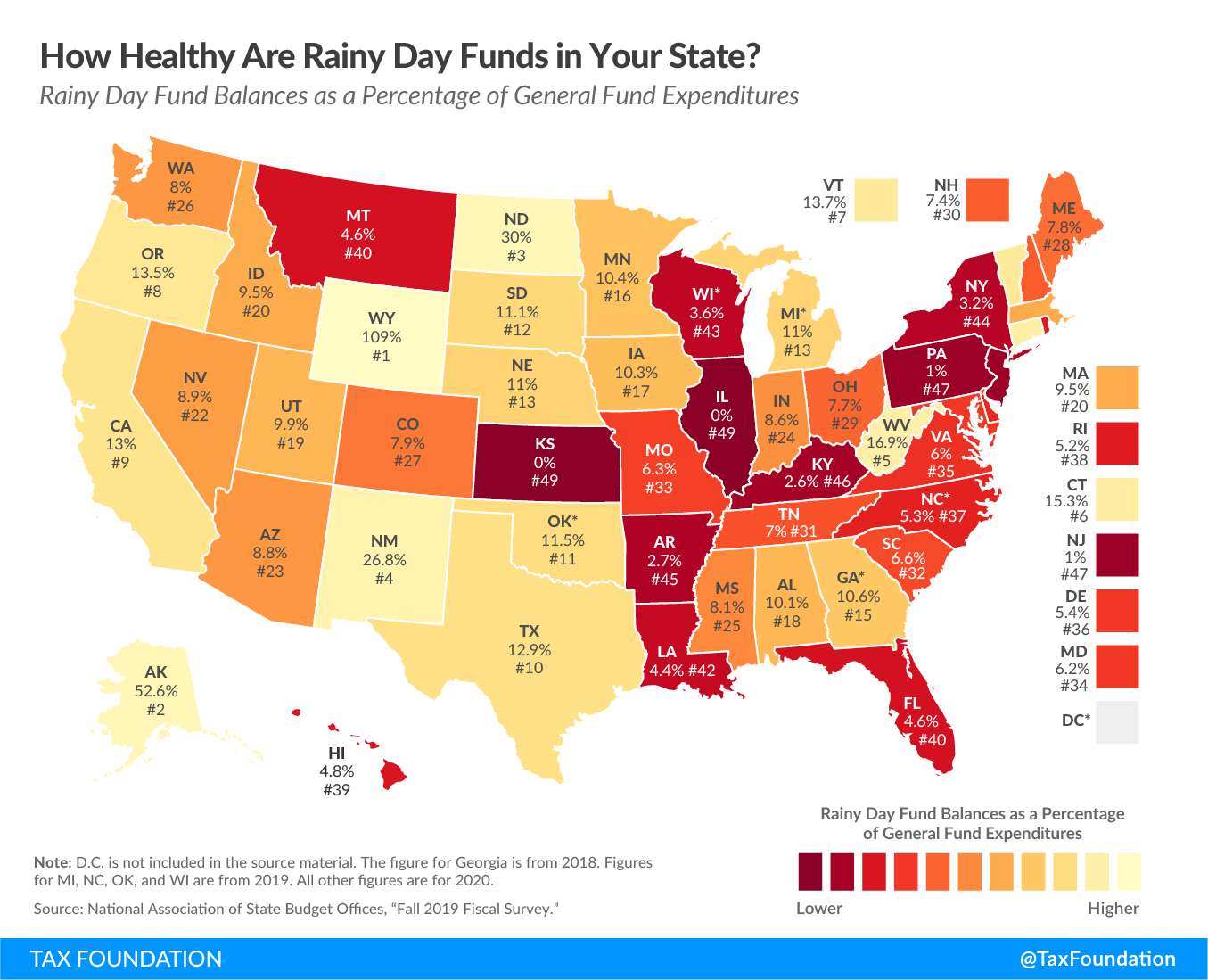

- The median rainy day fund balance is 8 percent of state general fund expenditures, but several states have little or no reserve funding.

- Withdrawal conditions vary, with states differing on whether access to the rainy day fund is triggered by budget gaps, economic or revenue volatility, or forecast errors, or whether any specific reason is required at all.

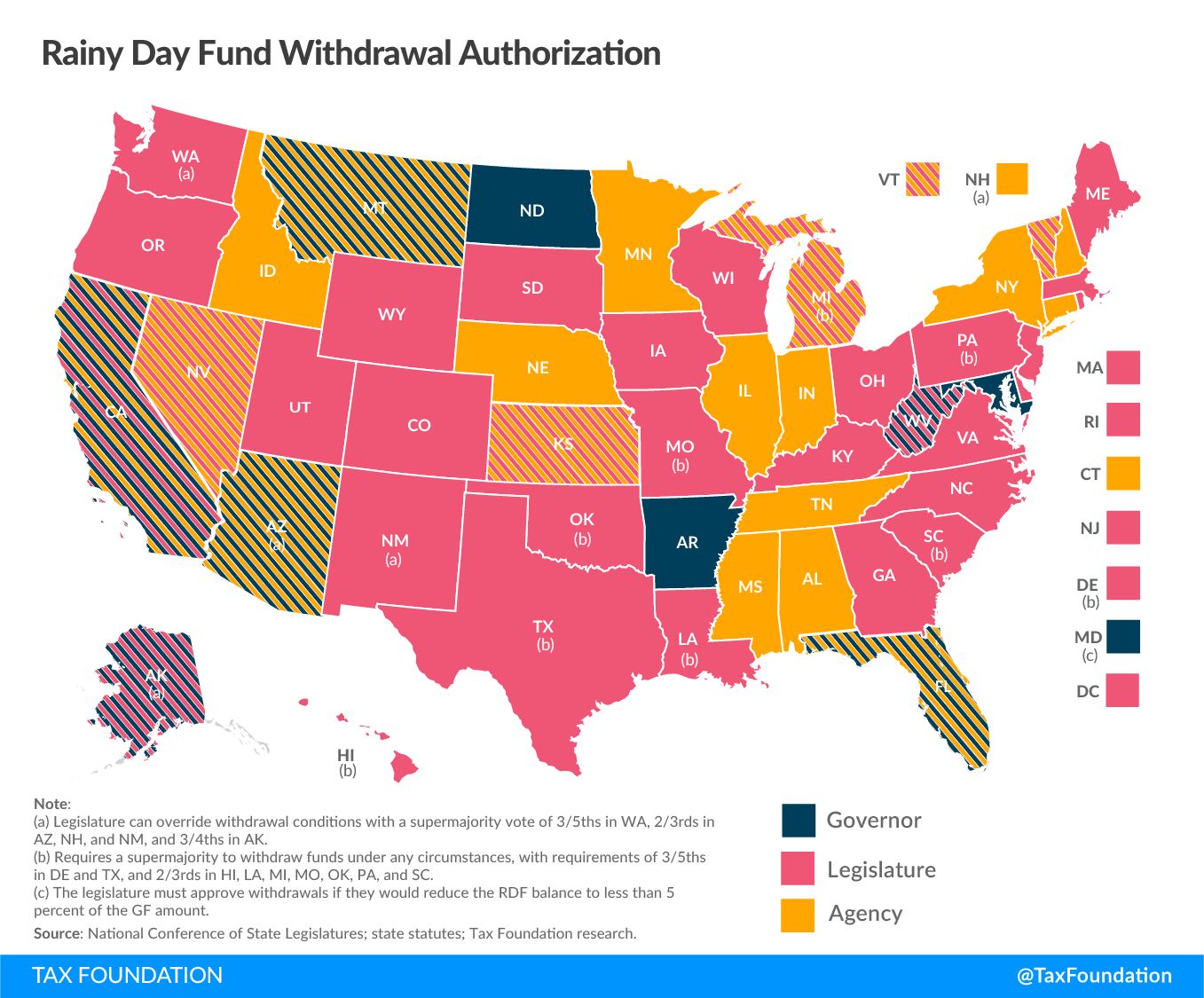

- Governors or agency officials are empowered to make fund withdrawals without a legislative appropriation in 24 states, while legislatures may appropriate from rainy day funds in 33 states, with an overlap of seven states in which there is concurrent authority.

- Twelve states restrict how much can be withdrawn from a rainy day fund in a given year, capping withdrawals based on a percentage of the prior year’s general fund appropriations, a percentage of the current balance of the rainy day fund itself, or a specific dollar amount.

- Eight states impose repayment requirements on their primary rainy day fund, with four requiring some or all of the money to be repaid in the next fiscal year.

- Rainy day funds are a valuable tool for state governments as they address the present crisis, but they are only one tool of many and should not be used as an excuse to postpone necessary budget decisions.

Introduction

There is nothing new about the idea of saving for a rainy day. Aesop, in his fable, contrasted the industrious ant who saved for the winter with the grasshopper who lived only for the day; the Bible records the story of Joseph, who, foreseeing a time of bounty to be followed by seven years of famine, advised Pharaoh to set aside grain in storehouses in the good years to get Egypt through the lean years. Today’s officials may not posses the ability to interpret dreams, and certainly never planned for an economic contraction like the one brought on by the COVID-19 pandemic, but they too could see the specter of lean years ahead.

Some states, much like the biblical Joseph or the Aesopic ant, made preparations, using revenue stabilization funds—often termed “rainy day funds”—to store some of the excess in the good years to get them through the sort of crisis we now face. Others, unfortunately, did little to prepare for a downturn that was inevitable, even if these particular circumstances were not predictable.

Much has been written on these funds, and much is still to be written. What follows is not intended to be a comprehensive description or evaluation of these funds, their structure, or their use. Rather, it is designed as a quick field guide to states’ reserves and their ability to use them as revenues decline during the COVID-19 crisis.

Each rainy day fund’s design is unique. In some states, only part of the balance can be used in a given year. Often, certain conditions must be met in order to make a withdrawal. The mechanics of approving a withdrawal also differ. And of course, states vary on how much they have in reserves. All these details will matter now that the longest period of economic expansion in U.S history has given way to a sharp, pandemic-linked economic contraction.

Sources of Revenue Shortfalls

The current crisis will affect almost every meaningful source of state revenue. The timing and intensity of these effects will, however, vary. Income taxes, which are always volatile, fall sharply during a recession as workers are laid off or see their incomes reduced, and as many taxpayers claim substantial capital losses. With record numbers of unemployment compensation claims,[1] states have good reason to fear highly significant declines in income taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. revenue.

Corporate income taxes tend to decline even more steeply than individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. es during a recession, and to take longer to recover. This is because corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. es are imposed on net income, and many businesses lose money during a downturn while accruing losses that can carry forward even after the recovery begins.

Sales taxA sales tax is levied on retail sales of goods and services and, ideally, should apply to all final consumption with few exemptions. Many governments exempt goods like groceries; base broadening, such as including groceries, could keep rates lower. A sales tax should exempt business-to-business transactions which, when taxed, cause tax pyramiding. es are usually among the most stable during economic contractions, because consumption patterns remain considerably more constant than income. Savings tend to be reduced before, and more aggressively than, personal expenditures, and those who begin receiving unemployment benefits or other government assistance see the decline or elimination of their taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. but continue to have taxable expenses. However, the COVID-19 pandemic is unique inasmuch as social distancing and shelter-in-place orders, along with mandatory closures of many non-essential businesses, have led to a sharp contraction of consumer spending. The goods and services seeing spikes in demand, moreover, such as groceries and digital entertainment, are less likely to be subject to state sales tax.[2]

If the public health crisis extends for months, therefore, sales tax revenues will be among the hardest hit. If, however, closure orders can be lifted more quickly, sales tax revenues should recover far more quickly than income tax revenues, because (at least when people can leave their homes) even in periods of economic contraction, consumption patterns do not decline commensurate with income. If those newly unemployed no longer have any taxable income, they would still make taxable purchases.

Excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. revenues will be adversely affected as well and may be eliminated entirely in some cases. Telework and other reductions in travel will wreak havoc on revenue from motor fuel taxes, while special excise taxes on tourism and hospitality will plummet. Closures of casinos, bars, and other establishments responsible for considerable “sin tax” revenue will also impact states’ bottom lines.[3]

Even timing issues will come into play, particularly as states permit tax filing and payment delays as a means of financial assistance and a way to help taxpayers avoid collecting receipts and visiting tax preparers’ offices during a pandemic. Income taxes are typically withheld throughout the year, or paid quarterly, limiting the impact of delayed filing and payment, but postponing an income tax payment date from April 15 to July 15, or delaying requirements for remitting sales or other taxes, can still be significant, pushing some collections into the next fiscal year just as states are trying to close out the current one.

Meanwhile, the coronavirus crisis will dramatically expend the use of public benefits and social insurance programs, from unemployment benefits to SNAP benefits and other assistance funded wholly or in part by states. The Great Recession is the most analogous situation, but early indications of initial unemployment benefit claims, and the potential for a lengthy societal dislocation, could quickly make the comparison inadequate.

Most states will curtail spending. Some will raise taxes, though they may try to hold out until the economic recovery has begun. Federal transfers will help. So will rainy day funds, which are intended for just such a time as this, helping states bridge both timing shifts and real revenue shortfalls.

State Reserve Levels

The median rainy day fund’s balance was 8 percent of state general fund expenditures entering fiscal year 2020, far better than the 4.8 percent balance states posted at the beginning of fiscal year 2008, prior to the Great Recession.[4] Some states have multiple rainy day funds with different provisions and purposes; where that is the case, they are combined here.

| State | Amount ($ millions) | Percent of Expenditures |

|---|---|---|

| Alabama | $945 | 10.1% |

| Alaska | $2,279 | 52.6% |

| Arizona | $1,019 | 8.8% |

| Arkansas | $153 | 2.7% |

| California | $19,204 | 13.0% |

| Colorado | $1,046 | 7.9% |

| Connecticut | $2,965 | 15.3% |

| Delaware | $252 | 5.4% |

| Florida | $1,574 | 4.6% |

| Georgia (a) | $2,557 | 10.6% |

| Hawaii | $396 | 4.8% |

| Idaho | $373 | 9.5% |

| Illinois | $4 | 0.0% |

| Indiana | $1,446 | 8.6% |

| Iowa | $784 | 10.3% |

| Kansas | $0 | 0.0% |

| Kentucky | $304 | 2.6% |

| Louisiana | $430 | 4.4% |

| Maine | $306 | 7.8% |

| Maryland | $1,198 | 6.2% |

| Massachusetts | $3,308 | 9.5% |

| Michigan (b) | $1,149 | 11.0% |

| Minnesota | $2,487 | 10.4% |

| Mississippi | $465 | 8.1% |

| Missouri | $654 | 6.3% |

| Montana | $118 | 4.6% |

| Nebraska | $510 | 11.0% |

| Nevada | $394 | 8.9% |

| New Hampshire | $115 | 7.4% |

| New Jersey | $401 | 1.0% |

| New Mexico | $2,015 | 26.8% |

| New York | $2,476 | 3.2% |

| North Carolina (b) | $1,254 | 5.3% |

| North Dakota | $727 | 30.0% |

| Ohio | $2,692 | 7.7% |

| Oklahoma (b) | $806 | 11.5% |

| Oregon | $1,487 | 13.5% |

| Pennsylvania | $340 | 1.0% |

| Rhode Island | $210 | 5.2% |

| South Carolina | $569 | 6.6% |

| South Dakota | $189 | 11.1% |

| Tennessee | $1,100 | 7.0% |

| Texas | $7,830 | 12.9% |

| Utah | $791 | 9.9% |

| Vermont | $226 | 13.7% |

| Virginia | $1,375 | 6.0% |

| Washington | $1,948 | 8.0% |

| West Virginia | $810 | 16.9% |

| Wisconsin (b) | $649 | 3.6% |

| Wyoming | $1,667 | 109.0% |

| District of Columbia | $1,430 | 14.4% |

|

Source: National Association of State Budget Officers. (a) Balance from FY 2018 due to data limitations. |

||

Two states, Illinois and Kansas, have almost completely empty reserve funds. Another two states, New Jersey and Pennsylvania, both have funds valued at only 1 percent of their general fund expenditures. Similarly alarming is a balance of 3.2 percent of general fund expenditures in New York, given the intensity of the pandemic in that state.[5]

Conversely, several states with a heavy reliance on natural resources made large deposits during the oil and natural gas boom, intended to see them through fluctuation in energy markets. States like Wyoming (109.0 percent), Alaska (52.6 percent), North Dakota (30.0 percent), and New Mexico (26.8 percent) have rainy day funds that would be the envy of the nation were it not for the unique challenges resource-dependent states face as energy prices plummet.[6]

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeWithdrawal Conditions

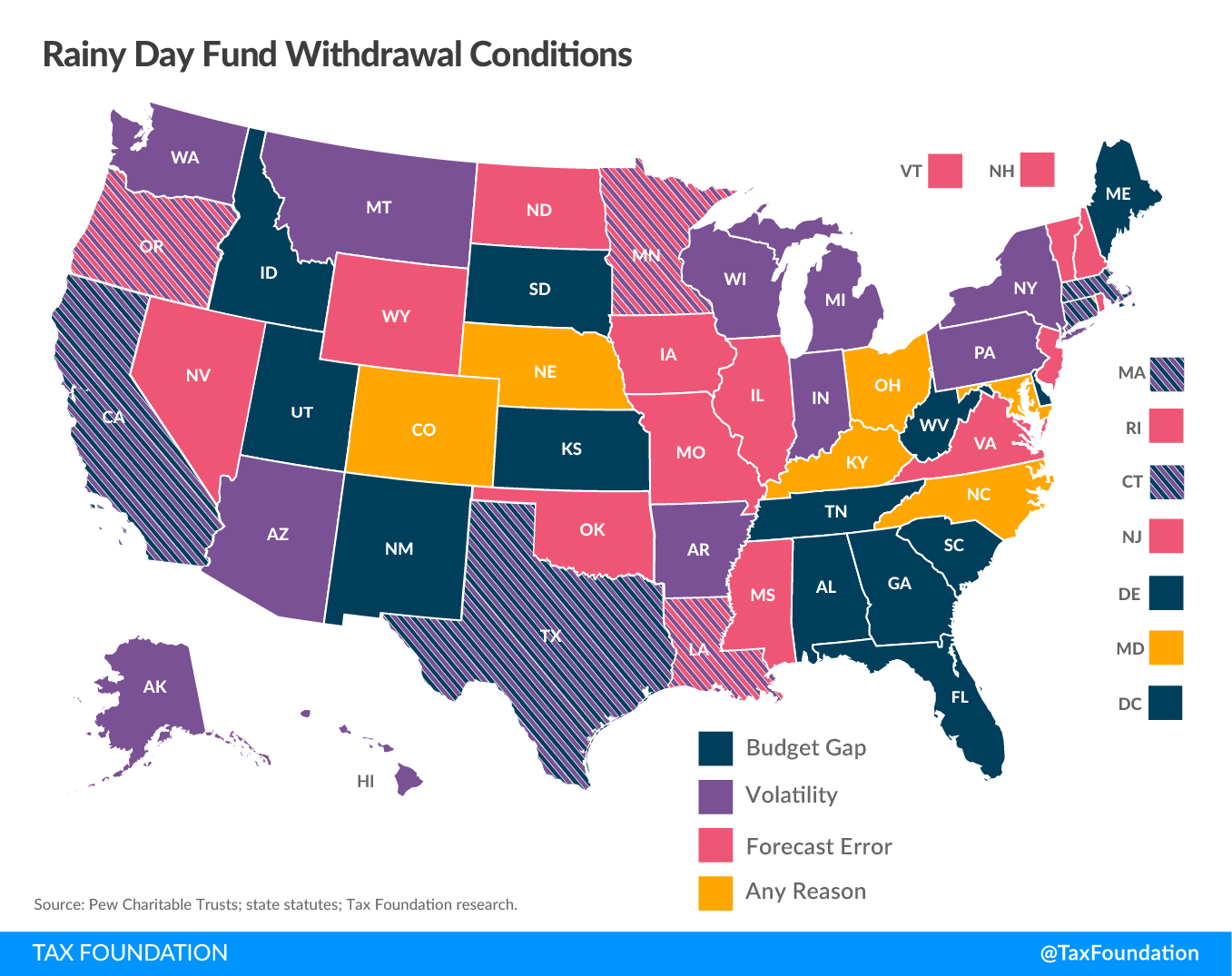

States frequently limit the circumstances under which rainy day funds can be used, since they are intended to provide a buffer for the state during an economic downturn or when facing unforeseen expenses and do not exist simply as an unappropriated balance to be used for new spending priorities. Although each state spells out its withdrawal conditions slightly differently, state requirements can be conceptualized through a three-part typology: budget gaps, volatility, and forecast errors.[7]

These three types of withdrawal conditions have substantial overlap; it is frequently the case that a withdrawal could be triggered under any one of them. Notably, a few states impose no such restrictions, either expressly allowing rainy day funds to be depleted for any reason or implicitly granting such authority through silence.

The first withdrawal condition is the existence of a budget gap. Most states require budgets to be balanced when adopted,[8] but unanticipated expenses (arising, for instance, from higher-than-expected utilization of social welfare programs) or lower-than-expected revenues can knock budgets out of balance. In many states, the emergence of such a budget gap permits a withdrawal from the state’s rainy day fund. In some states, the budget gap must be of a certain size to authorize a withdrawal.

The second possible condition is volatility—either revenue or economic. Here, a sufficient decline in revenues year-over-year, or a contraction of the economy beyond a given threshold, is necessary to allow appropriations to be made from the rainy day fund. Volatility conditions are the most conducive to building rainy day fund withdrawals into the budget, as the use of the fund does not require waiting for a budget gap to emerge; rather, lawmakers can respond to an economic downturn or revenue decline by tapping the rainy day fund as a source of revenue.

The third condition is forecast error, where revenue projections are downwardly adjusted (beyond a certain threshold) after the fiscal year has begun. Since forecast errors frequently lead to budget gaps, a forecast error condition substantially overlaps with budget gap conditions, but the two are not identical. Cost overruns do not constitute a revenue forecast error, for instance, and the availability of additional funds—from the federal government, or by sweeping funds from other accounts—can cause budget gaps and forecast errors to diverge.

Eighteen states allow one or more of their rainy day funds to be accessed on the basis of a budget gap, 18 permit the funds to be used conditioned on economic or revenue volatility, and 16 authorize fund appropriations due to forecast error. Six states allow withdrawals under either of two of the three conditions. Finally, six states do not place conditions on withdrawals.[9]

| State | Budget Gap | Volatility | Forecast Error | Any Reason |

|---|---|---|---|---|

| Alabama | ✓ | |||

| Alaska | ✓ | |||

| Arizona | ✓ | |||

| Arkansas | ✓ | |||

| California | ✓ | ✓ | ||

| Colorado | ✓ | |||

| Connecticut | ✓ | ✓ | ||

| Delaware | ✓ | |||

| Florida | ✓ | |||

| Georgia | ✓ | |||

| Hawaii | ✓ | |||

| Idaho | ✓ | |||

| Illinois | ✓ | |||

| Indiana | ✓ | |||

| Iowa | ✓ | |||

| Kansas | ✓ | |||

| Kentucky | ✓ | |||

| Louisiana | ✓ | ✓ | ||

| Maine | ✓ | |||

| Maryland | ✓ | |||

| Massachusetts | ✓ | ✓ | ||

| Michigan | ✓ | |||

| Minnesota | ✓ | ✓ | ||

| Mississippi | ✓ | |||

| Missouri | ✓ | |||

| Montana | ✓ | |||

| Nebraska | ✓ | |||

| Nevada | ✓ | |||

| New Hampshire | ✓ | |||

| New Jersey | ✓ | |||

| New Mexico | ✓ | |||

| New York | ✓ | |||

| North Carolina | ✓ | |||

| North Dakota | ✓ | |||

| Ohio | ✓ | |||

| Oklahoma | ✓ | |||

| Oregon | ✓ | ✓ | ||

| Pennsylvania | ✓ | |||

| Rhode Island | ✓ | |||

| South Carolina | ✓ | |||

| South Dakota | ✓ | |||

| Tennessee | ✓ | |||

| Texas | ✓ | ✓ | ||

| Utah | ✓ | |||

| Vermont | ✓ | |||

| Virginia | ✓ | |||

| Washington | ✓ | |||

| West Virginia | ✓ | |||

| Wisconsin | ✓ | |||

| Wyoming | ✓ | |||

| District of Columbia | ✓ | |||

|

Sources: Pew Charitable Trusts; state statutes; Tax Foundation research. |

||||

Withdrawal Authorization

Because rainy day funds are designed to help states address unanticipated budget challenges, they can in many cases be utilized without a vote of the legislature, though in some cases legislative leaders or committees may be consulted even if ultimate authority rests with the governor or an executive or legislative agency. In 24 states, the governor or an agency is empowered to withdraw money from the rainy day fund, subject to legal limitations on utilization. The governor possesses such authority in nine states; of these, the legislature has concurrent authority to initiate a rainy day fund withdrawal through appropriations in three, and agencies share such authority with governors in another three.[10]

In total, revenue commissioners, comptrollers, and other agency officials may authorize rainy day fund withdrawals in 19 states, while legislative bodies may appropriate funds from them in 33 states and the District of Columbia. California is the only state to separately empower the governor, the legislature, and an executive agency to authorize the use of the rainy day fund, but nine states authorize two different entities to initiate withdrawals.

During the COVID-19 pandemic, states in which the governor or an agency can withdraw funds from a revenue stabilization account may be at an advantage, given the difficulty of convening the legislature under these unusual circumstances. Understandably, however, many states have been wary of granting a single elected official or unelected agency the authority to make these decisions outside the legislative process, and sometimes there are more restrictions on gubernatorial authorizations than there are on legislative appropriations.

| State | Governor | Legislature | Agency |

|---|---|---|---|

| Alabama | ✓ | ||

| Alaska (a) | ✓ | ✓ | |

| Arizona (a) | ✓ | ✓ | |

| Arkansas | ✓ | ||

| California | ✓ | ✓ | ✓ |

| Colorado | ✓ | ||

| Connecticut | ✓ | ||

| Delaware (b) | ✓ | ||

| Florida | ✓ | ✓ | |

| Georgia | ✓ | ||

| Hawaii (b) | ✓ | ||

| Idaho | ✓ | ||

| Illinois | ✓ | ||

| Indiana | ✓ | ||

| Iowa | ✓ | ||

| Kansas | ✓ | ✓ | |

| Kentucky | ✓ | ||

| Louisiana (b) | ✓ | ||

| Maine | ✓ | ||

| Maryland (c) | ✓ | ||

| Massachusetts | ✓ | ||

| Michigan (b) | ✓ | ✓ | |

| Minnesota | ✓ | ||

| Mississippi | ✓ | ||

| Missouri (b) | ✓ | ||

| Montana | ✓ | ✓ | |

| Nebraska | ✓ | ||

| Nevada | ✓ | ✓ | |

| New Hampshire (a) | ✓ | ||

| New Jersey | ✓ | ||

| New Mexico (a) | ✓ | ||

| New York | ✓ | ||

| North Carolina | ✓ | ||

| North Dakota | ✓ | ||

| Ohio | ✓ | ||

| Oklahoma (b) | ✓ | ||

| Oregon | ✓ | ||

| Pennsylvania (b) | ✓ | ||

| Rhode Island | ✓ | ||

| South Carolina (b) | ✓ | ||

| South Dakota | ✓ | ||

| Tennessee | ✓ | ||

| Texas (b) | ✓ | ||

| Utah | ✓ | ||

| Vermont | ✓ | ✓ | |

| Virginia | ✓ | ||

| Washington (a) | ✓ | ||

| West Virginia | ✓ | ✓ | |

| Wisconsin | ✓ | ||

| Wyoming | ✓ | ||

| District of Columbia | ✓ | ||

|

Sources: National Conference of State Legislatures; state statutes; Tax Foundation research. (a) Legislature can override withdrawal conditions with a supermajority vote of 3/5ths in WA, 2/3rds in AZ, NH, and NM, and 3/4ths in AK. |

|||

Rainy Day Fund Withdrawal Limits

Twelve states restrict how much can be withdrawn from a rainy day fund (RDF) in a given year, capping withdrawals based on a percentage of the prior year’s general fund (GF) appropriations, a percentage of the current balance of the rainy day fund itself, or a specific dollar amount. Such caps are designed to allow the rainy day fund balance to provide multiple years of relief during a downturn, and to force the legislature to make other adjustments during a steep economic contraction rather than attempting to delay the inevitable by exhausting the rainy day fund prematurely.

Virginia seeks to require prudence from legislators by not only capping withdrawals at 50 percent of the rainy day fund’s balance but also restricting the withdrawn amount to 50 percent of the projected shortfall, forcing the legislature to cover the remainder of the shortfall by other means. Three states impose a limit based on prior year appropriations, eight restrict the percentage of the fund that can be depleted, and one state (Mississippi) adopts a dollar-denominated cap.[11]

The table below outlines these appropriations limits while estimating the maximum amount that each state would be authorized to withdraw under the cap. Idaho’s cap is not currently in effect and North Carolina’s cap is in excess of the total amount in its rainy day fund, so in those cases the estimated cap is identical to the state’s rainy day fund balance.

| State | Estimated Cap | Appropriations Limits | Fund Balance Limits |

|---|---|---|---|

| Alabama (a) | $682 million | 10% GF / 6.5% ETF | — |

| Arizona (b) | $510 million | — | 50% of balance |

| Hawaii | $198 million | — | 50% of balance |

| Idaho (c) | $373 million | — | 50% of balance |

| Louisiana | $143 million | — | 33.3% of balance |

| Mississippi | $50 million | — | $50 million |

| Missouri | $327 million | — | 50% of balance |

| North Carolina | $1.25 billion | 7.5% prior year GF | — |

| Oklahoma (d) | $403 million | — | 50% of balance |

| Tennessee (e) | $550 million | — | 50% of balance |

| Virginia (f) | $688 million | — | 50% of balance |

| West Virginia | $463 million | 10% prior year GF | — |

|

Sources: National Conference of State Legislatures; state statutes; state revenue departments; Tax Foundation research and calculations. (a) Estimated cap is combined value of 10% of the general fund and 6.5% of the education trust fund (ETF). |

|||

Utilization Considerations

Rainy day funds are meant to be used, and the COVID-19 pandemic and related economic contraction certainly qualifies as an appropriate time to use these reserves. Because these funds are far from inexhaustible, however, states should not view them as the first recourse as revenues decline, but rather as one tool of many. Using revenue reserves to maintain current levels of expenditure until the money runs out will prove highly irresponsible as the crisis goes on. No state’s rainy day fund is likely to be adequate to support the uninterrupted continuation of all government expenditures during a deep and protracted crisis. These funds can, however, serve as a valuable way to bridge delayed tax receipts, to reduce the intensity of budget cuts, and to provide policymakers with a broader array of options in addressing the crisis.

States should also be cognizant of whether—and when—withdrawals from state rainy day funds must be repaid. Most states have no specific provisions requiring replenishment of funds after their use, beyond the deposit requirements that apply in any year. However, eight states impose repayment conditions on their primary rainy day fund, with Missouri, Rhode Island, Texas, and Wyoming mandating the quickest replenishment.

Four of the eight states with repayment provisions grant governments several years before payments must be made. They are Alabama (within 10 years), Florida (three years after, but legislature can adjust), New York (three years after for one fund and six years after for another, but the former can be adjusted when responding to catastrophes), and South Carolina (within five years). In Missouri, repayment must be made in three years, with the first appropriation in the immediately following fiscal year. Rhode Island and Wyoming require full repayment the fiscal year following a withdrawal, and Texas requires that funds be repaid no later than August 31st of the next odd-numbered year.[12] These repayment schedules should help guide state decisions about how quickly to exhaust their reserve funds.

Conclusion

Rainy day funds are a valuable tool for state governments as they address the present crisis, but they are only one tool of many and should not be used as an excuse to postpone necessary budget decisions. Having learned the lesson of the Great Recession, most—but not all—states are better prepared than they were then, but the present need should be a reminder of the importance of funding these reserve accounts again once the current crisis is over.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Jared Walczak and Tom VanAntwerp, “A Visual Guide to Unemployment Benefit Claims,” Tax Foundation, Apr. 2, 2020, https://taxfoundation.org/unemployment-insurance-claims/.

[2] Jared Walczak, “Income Taxes Are More Volatile Than Sales Taxes During an Economic Contraction,” Tax Foundation, Mar. 17, 2020, https://taxfoundation.org/income-taxes-are-more-volatile-than-sales-taxes-during-recession/.

[3] Ulrik Boesen, “What Happens with State Excise Tax Revenue During a Pandemic?” Tax Foundation, Mar. 25, 2020, https://taxfoundation.org/happens-state-excise-tax-revenues-pandemic/.

[4] National Association of State Budget Officers, “Fiscal Survey of the States,” Fall 2019, https://www.nasbo.org/reports-data/fiscal-survey-of-states.

[5] Id.

[6] Jared Walczak, “Navigating Alaska’s Fiscal Crisis,” Tax Foundation, Jan. 30, 2020, https://taxfoundation.org/alaska-fiscal-crisis/.

[7] Pew Charitable Trusts, “When to Use State Rainy Day Funds,” April 2017, 6-10, http://www.pewtrusts.org/~/media/assets/2017/04/when-to-use-state-rainy-day-funds.pdf.

[8] Jared Walczak, “State Strategies for Closing FY 2020 with a Balanced Budget,” Tax Foundation, Apr, 2, 2020, https://taxfoundation.org/fy-2020-state-budgets-fy-2021-state-budgets/.

[9] Pew Charitable Trusts, “When to Use State Rainy Day Funds,” 18-21.

[10] National Conference of State Legislatures, “Rainy Day Fund Structures,” November 2018, 8-23, https://www.ncsl.org/Portals/1/Documents/fiscal/RDF_2018_Report.pdf.

[11] Id.

[12] Pew Charitable Trusts, “When to Use State Rainy Day Funds,” 22.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe