Key Findings

- Last-in, first-out (LIFO) and first-in, first-out (FIFO) are two methods of inventory accounting used for both financial accounting and taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. purposes.

- Both LIFO and FIFO rely on the accounting principle of deducting costs from income when goods are sold.

- This principle often comes into conflict with the economic principle of deducting costs when incurred, which prevents inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. from eroding the deduction’s value.

- However, LIFO comes close to matching the economic ideal while still remaining true to the accounting principle.

- Repealing the option to use LIFO would reduce long-run GDP by less than 0.05 percent ($5.6 billion), long-run wages by less than 0.05 percent, and employment by approximately 7,000 jobs.

- LIFO repeal would also impose a punitive one-time tax on the historical benefits of LIFO, which would come with higher short-term economic costs, particularly on smaller firms incapable of absorbing the tax.

- Repealing LIFO would disincentivize inventory investment, hampering efforts to make US supply chains more resilient and penalizing goods-producing and goods-trading industries.

Introduction

The corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. falls on corporate profits, or revenues minus costs. However, calculating corporate profits is no simple matter. The rules governing exactly how companies deduct their costs are a massive part of tax policy.

Inventory is one type of cost. There are several methods available for companies to account for their inventory when calculating taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. .[1] The last-in, first-out (LIFO) method allows companies to deduct the cost of their most recent unit of inventory acquired when they make a sale.

Repealing LIFO accounting appeared in several Obama administration budget proposals.[2] It also appeared in the Dave Camp tax reform package in 2014, and a few more recent bills in Congress have targeted the provision.[3] However, LIFO repeal has not been a focus of recent tax policy debates.[4]

Its absence from these debates is commendable. While LIFO inventory accounting may be a less widely understood part of the tax code, it is a sound structural component and brings companies closer to deducting their real cost of goods sold (COGS).

How LIFO Works

The LIFO inventory method allows companies to deduct the cost of inventory at the price of the most recently acquired items and assumes that the last inventory purchased is the first to be sold. The first-in, first-out (FIFO) inventory method, by contrast, allows companies to deduct the cost of inventory at the price of the oldest acquired items and assumes the first inventory purchased is the first to be sold.

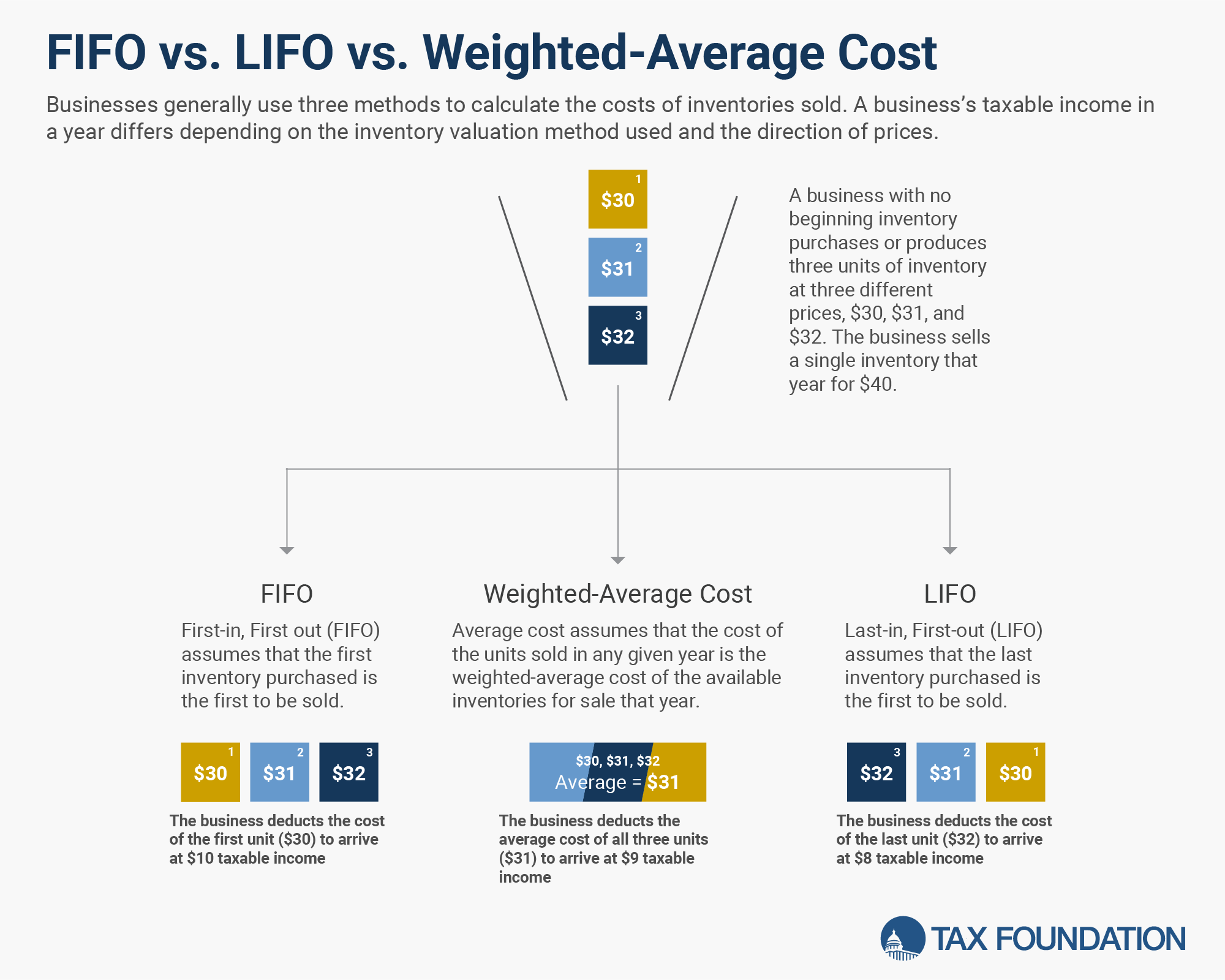

To demonstrate the differing effects of LIFO and FIFO, consider a company with no beginning inventory that purchases three units of inventory over the course of the year: one for $30 in January, one for $31 in June, and one for $32 in November. The firm then sells one unit for $40 in December. In this simplified example, assume inventory is the company’s only cost.

If the company used the FIFO inventory accounting method, it would deduct the cost of the first unit of inventory purchased, namely the unit purchased for $30 in January. Subtract $30 in costs from the $40 in revenue, and the company has $10 in income. Meanwhile, under the LIFO inventory accounting method, it would deduct the cost of the last unit of inventory purchased, namely the unit purchased for $32 in November. Subtract $32 in costs from $40 in revenue, and the company has $8 in income.

There are several other methods of inventory accounting, the most common being weighted average cost. When a unit of inventory is sold, companies can deduct the weighted average cost of every unit of inventory held. In the example case here, that would mean the company would deduct $31 in inventory costs when they sell a unit in December, leading to $9 in income.

The cumulative benefits of LIFO relative to FIFO are known as the LIFO reserve.

Firms also have the option to value units of inventory individually, through the specific valuation method.[5] In this case, the firm would deduct the cost of whichever unit of inventory (the one bought in January, the one bought in November, or the one bought in December) was sold.[6]

Reflecting Two Philosophies of Income

To understand the policy conversation about LIFO and FIFO, one must understand two main philosophies of calculating income: the pure income approach and the cash flow approach.

The income approach focuses on matching deductions for costs with the revenues they generate. For example, if a farm invests in a new tractor that it will use for 10 years, it should spread the deductions for that tractor out over the next 10 years. When applying this principle to inventories, companies should deduct the cost of a unit of inventory when it is sold.

The cash flow approach suggests companies should deduct their costs right when those costs are incurred. In the case of the farm investing in a new tractor, it should deduct the full cost of the tractor immediately. When applying this principle to inventories, companies should deduct the cost of a unit of inventory when it is acquired.

For accountants and financial analysts, the income (or book incomeBook income is the amount of income corporations publicly report on their financial statements to shareholders. This measure is useful for assessing the financial health of a business but often does not reflect economic reality and can result in a firm appearing profitable while paying little or no income tax. ) approach makes sense for determining the financial health of a company—this approach shows that, for instance, a decline in cash flow thanks to major investment decisions does not mean that the company is “losing money,” as those investment costs can get spread out. Meanwhile, the cash flow-based approach makes the most sense from a tax economics perspective because deducting investment costs when they are incurred means a company can deduct the full real cost, without inflation and the time value of money eating away at the deduction’s value (which occurs when deductions are spread over several years).

For some issues, companies can use one set of rules to calculate financial income and another set of rules to calculate taxable income—which also makes sense, as they measure different things.[7] But in the case of LIFO and FIFO, both systems are, at least on paper, based on the book income approach. Both systems have companies deduct the cost of a unit of inventory when it is sold, not when it is acquired, and companies must use the same system for both financial and taxable income.

However, LIFO can approximate the cash flow-based model of taxation because deducting the cost of the most recent unit of inventory whenever a unit of inventory is sold is often equivalent to deducting the cost of the most recent unit of inventory when it was acquired.

The LIFO/FIFO Decision

Firms face a trade-off when choosing their inventory accounting method. Generally, LIFO lowers both taxable income and financial income, while FIFO raises both taxable income and financial income. Choosing LIFO inventory accounting might be more economically sound, but it can lead to lower reported income to shareholders, which can push managers to adopt FIFO inventory accounting.

A few factors drive company choices of accounting method.[8] The first is how inventory costs typically change over time: if the cost of acquiring inventory typically increases over time, being able to deduct the newest rather than the oldest unit of inventory is more beneficial. Accordingly, the benefits of LIFO expand during periods of higher inflation. The second is the tax rate: the benefit of a larger deduction under LIFO is more significant if the deduction is taken against a higher tax rate. The third is inventory turnover: if inventory turnover is high, the gap between the acquisition cost of the last-in unit of inventory and first-in unit of inventory will be smaller, and, consequently, the tax benefit of LIFO will also be smaller. Lastly, if a company is expanding overall inventory levels, LIFO tax treatment is more beneficial.

Due to accounting rules, LIFO comes with some additional compliance challenges. Accordingly, some firms will forgo comparatively small benefits of LIFO arising from the above criteria. Recent academic evidence suggests companies will only choose LIFO if the tax benefit exceeds 0.35 percent of the cost of goods sold.[9] Changes to the overall economy have made LIFO a less appealing option for some companies.[10] With the exception of a recent blip, inflation rates have been low in recent decades. The statutory corporate tax rate is also lower, reducing the benefit of a larger deduction.[11] Some industries have seen increased inventory turnover as well.[12]

LIFO’s Macroeconomic and Revenue Impact

By raising the cost of working capital, repealing LIFO reduces long-run GDP by less than 0.05 percent ($5.6 billion), long-run wages by less than 0.05 percent, employment by approximately 7,000 jobs, and the size of the capital stock by 0.05 percent. However, if anything, the long-run impact of LIFO repeal understates its overall effect, as the policy would come with significant transition costs due to the tax on LIFO reserves. It would raise $104.7 billion in revenue on a static basis, but after factoring in the smaller economy, it would only raise $97.2 billion.

This estimate relies on some assumptions of the Congressional Budget Office and Joint Committee on Taxation’s modeling of repealing LIFO as well as the subnormal goods and lower of cost or market approaches to inventory valuation.[13]

Table 1. LIFO Repeal Would Have Small, Negative Economic Effect

Economic and Budgetary Effects of LIFO Repeal

| Change in Long-Run GDP | Less than -0.05% |

| Change in Long-Run GNP | Less than -0.05% |

| Change in Capital Stock | -0.05% |

| Change in Wage Rate | Less than -0.05% |

| Change in Full-Time Equivalent Jobs | -6720 |

| 10-Year Conventional Revenue (Billions) | $104.72 |

| 10-Year Dynamic Revenue (Billions) | $97.28 |

Unpacking LIFO’s Impact: Taxing LIFO Reserves

The 10-year revenue estimate of the effect of LIFO repeal needs context. The revenue would mostly be a one-time windfall for the first few years after LIFO repeal is implemented. In the long term, LIFO repeal raises minimal revenue, with the economic costs of LIFO further diminishing tax collections.

Table 2. LIFO Repeal Revenue Mostly a One-Time Shock, Provides Little in Long Run

10-Year Revenue Effects of LIFO Repeal, 2025-2034

| 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | 2032 | 2033 | 2034 | 2025-2034 | |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Conventional Revenue, Billions | 11.6 | 23.2 | 23.1 | 23.1 | 12.6 | 2.21 | 2.21 | 2.2 | 2.2 | 2.3 | 104.72 |

| Dynamic Revenue, Billions | 11.41 | 22.82 | 22.58 | 22.45 | 11.85 | 1.37 | 1.29 | 1.2 | 1.14 | 1.15 | 97.28 |

Table 3. In the Long Run, LIFO Repeal Raises Minimal Revenue

Revenue Effect of LIFO Repeal, 2034 (Billions)

| 2034 | |

|---|---|

| Conventional Revenue | 2.3 |

| Dynamic Revenue | 1.15 |

This one-time revenue boost, spread over the first five years of the budget window, results from the taxation of LIFO reserves. LIFO reserves are the accumulated benefits of having used the LIFO inventory accounting method over FIFO inventory accounting.

Levying a tax on these LIFO reserves may seem like a good idea on paper. Taxing past, rather than future, economic activity does not change economic incentives going forward. However, retroactive taxation is dicey. For example, one act of retroactive taxation may suggest the potential for future acts of retroactive taxation, which changes investment incentives in the present.

More importantly, in the case of LIFO, taxing LIFO reserves is not based on ability to pay. The LIFO reserve amounts vary dramatically from year to year as broader economic conditions and prices fluctuate, particularly in volatile commodity industries. This variation is part of the reason the revenue estimates of LIFO repeal can vary substantially over time—revenue estimates of LIFO repeal based on 2020 LIFO reserves, for instance, were roughly half of the current estimates of LIFO repeal, as prices of commodities like oil fell dramatically in 2020, reducing the value of LIFO reserves.[14] LIFO reserves are not cash balances; therefore, taxing them would create liquidity problems for firms that have used LIFO historically. While some companies may be able to manage a sudden tax on LIFO reserves, others using LIFO, including many smaller, family-owned businesses, would be more threatened.

Taxing LIFO reserves would amount to a tax on a set of companies that have seen increasing inventory costs over time, which is not an appropriate or economically coherent tax baseThe tax base is the total amount of income, property, assets, consumption, transactions, or other economic activity subject to taxation by a tax authority. A narrow tax base is non-neutral and inefficient. A broad tax base reduces tax administration costs and allows more revenue to be raised at lower rates. . One could apply retroactive taxes on other arbitrary types of historical activity, like a $1.50 per pack excise taxAn excise tax is a tax imposed on a specific good or activity. Excise taxes are commonly levied on cigarettes, alcoholic beverages, soda, gasoline, insurance premiums, amusement activities, and betting, and typically make up a relatively small and volatile portion of state and local and, to a lesser extent, federal tax collections. on cigarettes sold in 2008, a 5 percent surtaxA surtax is an additional tax levied on top of an already existing business or individual tax and can have a flat or progressive rate structure. Surtaxes are typically enacted to fund a specific program or initiative, whereas revenue from broader-based taxes, like the individual income tax, typically cover a multitude of programs and services. on income earned in the software industry in 2013, or a full clawback of all child tax creditA tax credit is a provision that reduces a taxpayer’s final tax bill, dollar-for-dollar. A tax credit differs from deductions and exemptions, which reduce taxable income, rather than the taxpayer’s tax bill directly. payments in 2005. All of these would carry the same supposed efficiency benefits of retroactive taxation as taxing LIFO reserves. We do not impose taxes like that for good reasons, and most of those reasons also apply to taxing LIFO reserves.[15]

Beyond the Macro: Where LIFO Repeal Matters in the Economy

Amidst higher inflation, generally, LIFO becomes more beneficial from a tax perspective. Many accounting firms advised companies to switch to LIFO in 2022.[16] According to economic research firm Hudson Labs (formerly Bedrock AI), though, about 30 US companies switched from LIFO to FIFO from 2021 to 2022, while no companies the firm studied have switched from FIFO to LIFO since 2019.[17] However, given the low prices, and therefore low LIFO reserves, in 2020, that year would have been an optimal time for any firms considering switching from LIFO to FIFO.

As mentioned earlier, lower inflation has been the general trend over recent decades, with 2021-2022 being an exception.[18] Understandably, if firms think inflation will soon return to 2 percent, a year or two of elevated inflation would not substantially alter their thought process on choice of accounting method. But if inflation remains elevated in the coming years, firms may find switching to LIFO more appealing, as inflation would increase the tax penalty associated with FIFO.

Furthermore, one might see the lack of transition to LIFO during the high inflation period of 2021-2022, and LIFO being used by a minority of US businesses, as justification for repealing LIFO. If anything, it is further justification for keeping it around. If the lower corporate tax rate has made more businesses marginally prefer FIFO treatment over LIFO treatment, then the businesses that have stayed with LIFO likely did so for very good reasons, such as being particularly inventory-intensive, planning to expand inventory, or having a relatively low inventory turnover ratio.[19] Accordingly, LIFO repeal would punish companies and industries that fit that description.

Physical Goods and Supply Chain Resiliency

One factor behind the decline of LIFO usage over time is the economy-wide shift away from goods and toward services. Typically, inventories are not a major part of COGS for a software company or financial services firm, but they are important for companies that actually sell tangible goods.[20] Studies of LIFO usage across the economy in the 2010s found benefits concentrated among oil and gas, equipment manufacturers, chemicals and primary metal manufacturers, and pharmaceutical wholesalers.[21] Repealing LIFO would penalize the goods-producing and goods-trading parts of the American economy, and taxing LIFO reserves could jeopardize small businesses in particular within those highlighted industries. In the long run, it would also put American firms in those industries (like equipment manufacturing and oil and gas) in a worse position relative to international competitors.

Repealing LIFO would also create a tax penalty on investments in supply chain resiliency. During the COVID-19 pandemic, as well as during subsequent supply chain disruptions, the practice of “just-in-time” inventory management (carefully minimizing the amount of inventory held) attracted criticism.[22] Companies that make greater investments in inventory can better mitigate the effects of negative supply shocks, and LIFO repeal would punish those resiliency-enhancing measures. Ironically, as tax economist Martin Sullivan noted in Tax Notes in 2022, the tax penalty would be particularly high in times of high inflation.[23]

LIFO opponents often cite the concentrated benefits of LIFO in specific industries like oil and gas as a reason for repealing it.[24] But many broad, neutral provisions of the tax code provide disproportionate benefits to some industries. A software firm would benefit more than a paper manufacturer from being able to deduct research and development (R&D) investment, because generally R&D is a more important part of the software firm’s business model.[25]

Thanks to recent geopolitical events such as the Russian invasion of Ukraine, domestic energy production has taken center stage. Repealing LIFO would create a tax penalty for oil and gas producers relative to less inventory-intensive industries, and it would be a marginal disincentive for investment in additional inventory and capacity that could help reduce the shocks of sudden swings in global markets.

Conclusion

While LIFO is rarely the main focus of the overall tax policy debate, it is a sound structural piece of the tax code. Repeal would penalize inventory purchases and disproportionately punish the segments of the American economy that deal in physical goods. In the long run, it would raise minimal revenue relative to its economic cost, while in the short run, it would impose high costs on a narrow, but important, subset of the economy.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe[1] Internal Revenue Service, “Accounting Periods and Methods,” Publication 438, revised January 2022, https://www.irs.gov/pub/irs-pdf/p538.pdf.

[2] Government Publishing Office, “Budget of the United States Government,” https://www.govinfo.gov/app/collection/budget/.

[3] Kyle Pomerleau and Andrew Lundeen, “The Basics of Chairman Camp’s Tax Reform Plan,” Tax Foundation, Feb. 26, 2014, https://taxfoundation.org/blog/basics-chairman-camp-s-tax-reform-plan/; H.R. 1483, “End Oil and Gas TaxA gas tax is commonly used to describe the variety of taxes levied on gasoline at both the federal and state levels, to provide funds for highway repair and maintenance, as well as for other government infrastructure projects. These taxes are levied in a few ways, including per-gallon excise taxes, excise taxes imposed on wholesalers, and general sales taxes that apply to the purchase of gasoline. Subsidies Act of 2023,” 118th Congress, introduced Mar. 9, 2023, https://www.congress.gov/bill/118th-congress/house-bill/1483.

[4] See, for instance, Benjamin Guggenheim, “Tax Policies Possibly on Chopping Block ID’d by Budget Committee,” PoliticoPro, Jan. 17, 2025, https://subscriber.politicopro.com/article/2025/01/new-budget-committee-document-highlights-tax-policies-on-chopping-block-00199003.

[5] Internal Revenue Service, “Accounting Periods and Methods.”

[6] Ibid.

[7] Erica York, “Understanding the GAAP Between Book and Taxable Income,” Tax Foundation, Jun. 3, 2021, https://taxfoundation.org/corporations-zero-corporate-tax/.

[8] Daniel Tinkelman and Qianhua Ling, “Costs and Benefits of the LIFO-FIFO Choice,” The Journal of Corporate Accounting and Finance 35:3 (July 2024), https://onlinelibrary.wiley.com/doi/10.1002/jcaf.22712.

[9] Ibid.

[10] Daniel Tinkelman and Qianhua Ling, “The Rise and Decline of LIFO,” Accounting Historians Journal 49:2 (December 2022), https://publications.aaahq.org/ahj/article-abstract/49/2/103/10063/The-Rise-and-Decline-of-LIFO.

[11] Ibid., see also Mark Maurer, “Inflation Has More U.S. Companies Ditching ‘Last-In, First-Out’ Accounting,” The Wall Street Journal, Mar. 23, 2023, https://www.wsj.com/articles/inflation-has-more-u-s-companies-ditching-last-in-first-out-accounting-27a0935c.

[12] Ibid., see also US Census Bureau, “Retailers: Inventories to Sales Ratio,” retrieved from FRED, Feb. 2, 2025, https://fred.stlouisfed.org/series/RETAILIRSA.

[13] Congressional Budget Office, “Repeal the ‘Last In, First Out’ Approach to Inventory Identification and the ‘Lower of Cost or Market and ‘Subnormal Goods’ Methods of Inventory Valuation” in Options for Reducing the Deficit: 2025 to 2034, Dec. 12, 2024, https://www.cbo.gov/budget-options/60957/.

[14] See, for instance, Alex Muresianu and Alex Durante, “Understanding the Tax Treatment of Inventory: The Role of LIFO,” Tax Foundation, Oct. 12, 2022, https://taxfoundation.org/research/all/federal/lifo-tax-treatment-inventory/; Congressional Budget Office, “Options for Reducing the Deficit: 2021 to 2030,” December 2020, https://www.cbo.gov/system/files/2020-12/56783-budget-options.pdf.

[15] The only exception here is administrative burdens.

[16] See, for instance, April Estes, Christine Turgeon, and Jim Martin, “Taxpayers Should Consider Immediate Action to Adopt the LIFO Inventory Method to Expense High Inflation,” PricewaterhouseCoopers, Feb. 1, 2022, https://www.pwc.com/us/en/tax-services/publications/insights/assets/pwc-consider-immediate-action-to-adopt-lifo-to-expense-high-inflation.pdf.

[17] Mark Maurer, “Inflation Has More U.S. Companies Ditching ‘Last-In, First-Out’ Accounting,” The Wall Street Journal, Mar. 23, 2023, https://www.wsj.com/articles/inflation-has-more-u-s-companies-ditching-last-in-first-out-accounting-27a0935c.

[18] US Bureau of Labor Statistics, “Consumer Price Index for All Urban Consumers: All Items in U.S. City Average [CPIAUCSL],” retrieved from Federal Reserve Bank of St. Louis, Feb. 4, 2025, https://fred.stlouisfed.org/series/CPIAUCSL.

[19] Daniel Tinkelman and Qianhua Ling, “Costs and Benefits of the LIFO-FIFO Choice.”

[20] CSI Market, “Inventory Turnover Ratio Screening as of Q4 of 2024,” accessed Feb. 2, 2025, https://csimarket.com/screening/index.php?s=it.

[21] Daniel Tinkelman, “Who Benefits from LIFO,” Tax Notes Federal, Dec. 18, 2017, https://www.taxnotes.com/tax-notes-federal/accounting-periods-and-methods/who-benefits-lifo/2017/12/18/1xc0x.

[22] Peter Goodman and Niraj Chokshi, “How the World Ran Out of Everything,” The New York Times, updated Oct. 22, 2021, https://www.nytimes.com/2021/06/01/business/coronavirus-global-shortages.html.

[23] Martin Sullivan, “Inventories, Inflation, and Supply Chain Disruption,” Tax Notes, Jun. 20, 2022, https://www.taxnotes.com/featured-analysis/inventories-inflation-and-supply-chain-disruption/2022/06/17/7dl0q.

[24] Thornton Matheson and Thomas Brosy, “Inflation and Oil Price Spikes Revive Case for LIFO Repeal,” Tax Policy Center, May 12, 2022, https://taxpolicycenter.org/taxvox/inflation-and-oil-price-spikes-revive-case-lifo-repeal.

[25] National Center for Science and Engineering Statistics and Census Bureau, “Table 17. Domestic R&D Paid for by the Company and Others and Performed by the Company as a Percentage of Domestic Net Sales, by Industry and Company Size: 2022,” National Science Foundation, September 2024, https://ncses.nsf.gov/surveys/business-enterprise-research-development/2022#data.

Share this article