Related Research

Last week, an economist at the Federal Reserve analyzed how tariffs on Chinese imports impact the U.S. manufacturing sector. An earlier analysis by the Peterson Institute for International Economics, summarized here, found that the Trump administration’s Section 301 tariffs almost exclusively apply to goods American companies import: 52 percent are intermediate inputs and 43 percent are capital equipment. This new analysis supports the idea that raising tariffTariffs are taxes imposed by one country on goods or services imported from another country. Tariffs are trade barriers that raise prices and reduce available quantities of goods and services for U.S. businesses and consumers. s on intermediate goods will hurt more manufacturers than it helps because it significantly increases costs of production across the U.S. manufacturing sector.

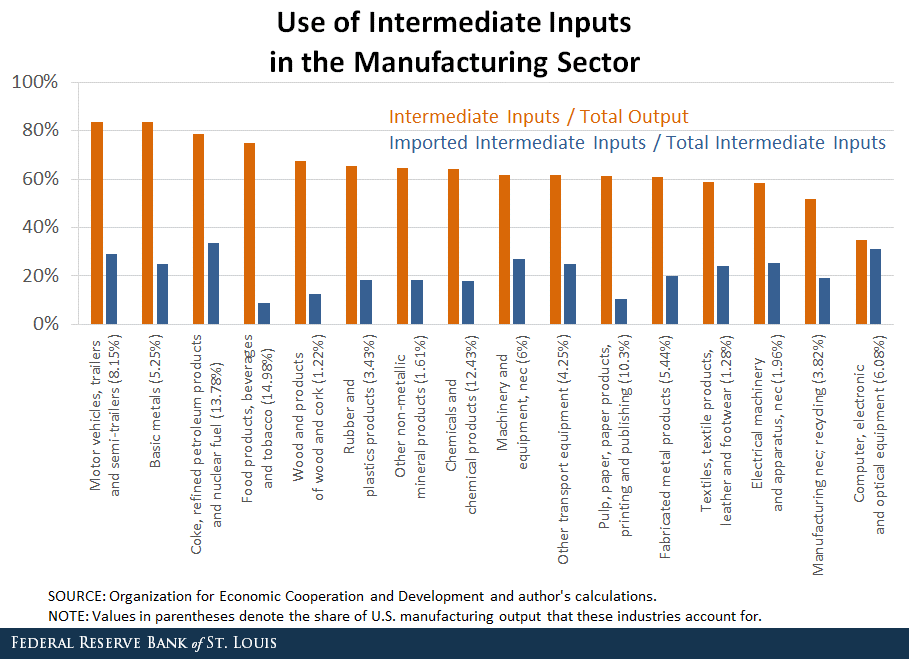

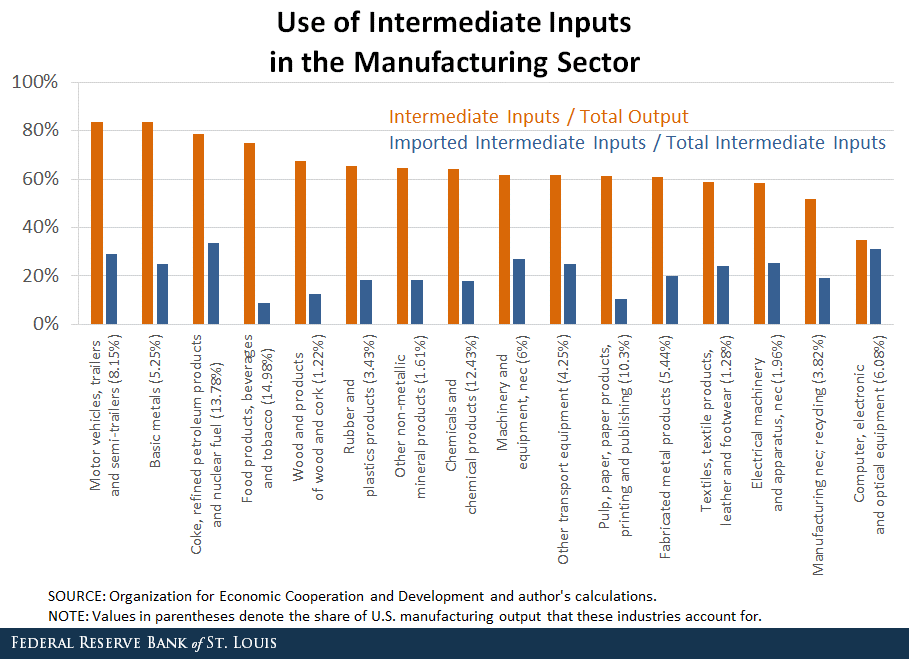

First, the author of the new analysis, Fernando Leibovici, looks at how the average U.S. manufacturing firm produces goods. U.S. manufacturing industries intensively use intermediate inputs (like those now subject to tariffs) in their manufacturing processes; intermediate inputs account for 64 percent of the total value of production on average. He then documents just how much U.S. manufacturers rely on other parts of the world to source these inputs: 22 percent of total intermediate inputs expenditure is from abroad. He summarizes these findings by saying:

This evidence suggests that raising tariffs on intermediate inputs may have a significant negative impact on U.S. manufacturers. By raising the price of intermediates, the recent tariff hike may force U.S. manufacturers to raise prices, thus hurting consumers and leading to cuts in production. Moreover, some firms might not be able to compete in this alternative environment and might have to shut down.

Next, Leibovici looks at which industries may be more impacted by higher prices caused by the Trump administration’s import tariffs. He finds the impact varies across 16 types of manufacturing activity, but all industries within the U.S. manufacturing sector source at least 10 percent of their intermediate inputs internationally. And, at the high end, the motor vehicles, trailers, and semitrailers industry sources about 30 percent of their intermediate goods from abroad. He argues that if it is difficult to find substitutes for these intermediate goods, the tariffs are likely to have a “significant impact on the functioning of U.S. manufacturers.” Here’s his breakdown of input use across the 16 activities:

His findings align with our previous analysis, which said U.S. firms that can will pass these higher costs on to the consumers of their products, leaving those consumers less money to spend elsewhere after paying higher prices for the goods affected by tariffs. Firms that cannot pass the costs on will, at best, have less cash flow to invest and expand in the U.S., or, at worst, will become unprofitable, lay off workers, or potentially go out of business. These tariffs increase production costs for U.S. manufacturers, placing them at a competitive disadvantage, and will, on net, destroy more output, wages, and employment in the United States than they create.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe