Since its founding in 1937, it has been a cornerstone of the Tax Foundation's educational mission to provide taxpayers, policymakers, and the public with reliable and accessible tax data.

As we wrote in the first edition of our ongoing state data project Facts & Figures in 1941: "There is a need for concise and accurate data. Facts give a broader perspective; facts dissipate predilections and prejudices."

Too often the facts we need to make informed decisions about our tax codes are buried on government websites or in academic papers. It's our goal with the datasets and visualizations below to extract that vital knowledge and make it available to everyone, in the hopes that it contributes to a healthier and more informed public debate.

Featured Projects

Facts & Figures 2023: How Does Your State Compare?

Facts & Figures serves as a one-stop state tax data resource that compares all 50 states on over 40 measures of tax rates, collections, burdens, and more.

2 min read

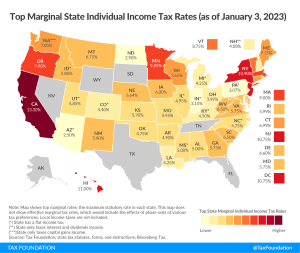

State Individual Income Tax Rates and Brackets, 2023

Individual income taxes are a major source of state government revenue, accounting for more than a third of state tax collections:

9 min read

Summary of the Latest Federal Income Tax Data, 2023 Update

The latest IRS data shows that the U.S. federal individual income tax continued to be progressive, borne primarily by the highest income earners.

43 min read

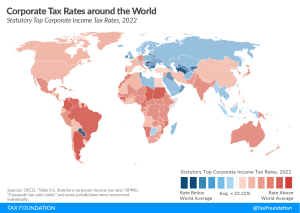

Corporate Tax Rates around the World, 2022

A new report shows that corporate tax rates around the world continue to level off. “We aren’t seeing a race to the bottom, we’re seeing a race toward the middle,” said Sean Bray, EU policy analyst at the Tax Foundation.

25 min read

2023 Tax Brackets

The IRS recently released the new inflation adjusted 2023 tax brackets and rates. Explore updated credits, deductions, and exemptions, including the standard deduction & personal exemption, Alternative Minimum Tax (AMT), Earned Income Tax Credit (EITC), Child Tax Credit (CTC), capital gains brackets, qualified business income deduction (199A), and the annual exclusion for gifts.

4 min read

State and Local Tax Burdens, Calendar Year 2022

Tax burdens rose across the country as pandemic-era economic changes caused taxable income, activities, and property values to rise faster than net national product. Tax burdens in 2020, 2021, and 2022 are all higher than in any other year since 1978.

24 min read