TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. es are time consuming and expensive for small businesses in the United States.

Nearly a quarter of small business owners in the United States spend over 120 hours each year dealing with their federal taxes, according to the most recent survey by the National Small Business Association. That’s three work weeks spent dealing with federal taxes. Additionally, over half of small business owners spend more than one work week (40 hours) on federal taxes each year, according to the most recent survey by the National Small Business Association.

According to the survey, these taxes come with a heavy cost as well, with over a quarter of businesses spending more than $10,000 each year on simply the administration of federal taxes. This does not include the actual tax burden, which 42 percent of respondents said creates the largest burden on their business.

Small business owners ranked payroll taxes and presenting the largest financial burden, followed by state and local tax compliance, income taxes, property taxA property tax is primarily levied on immovable property like land and buildings, as well as on tangible personal property that is movable, like vehicles and equipment. Property taxes are the single largest source of state and local revenue in the U.S. and help fund schools, roads, police, and other services. es, and capital gains taxA capital gains tax is levied on the profit made from selling an asset and is often in addition to corporate income taxes, frequently resulting in double taxation. These taxes create a bias against saving, leading to a lower level of national income by encouraging present consumption over investment. es. Nearly 70 percent of small business owners said that federal taxes have a moderate to significant impact on the day to day operations of their businesses.

The survey found that 70 percent of small business owners support tax reform that reduces corporate and individual tax rates and business and individual deductions.

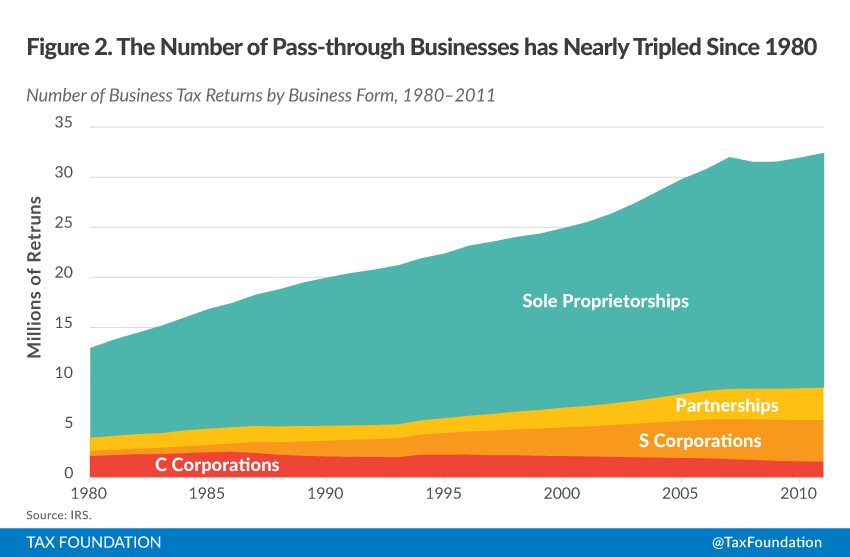

Pass-through businesses make up the vast majority of businesses in the U.S. today (chart below). This makes it crucial that tax reform fix both the individual and the corporate tax system.

This post originally appeared on Forbes.com.

Share