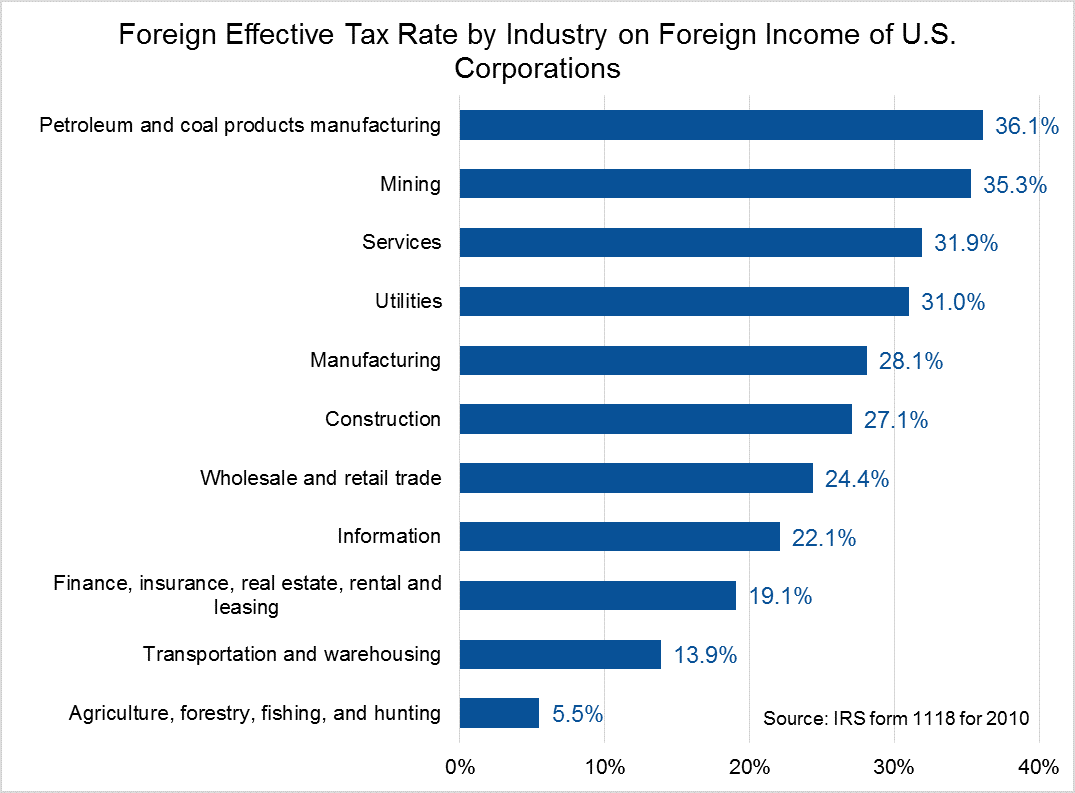

U.S. headquartered corporations pay an effective taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. rate of 27.2 percent on income earned in foreign countries. Not surprisingly, this rate varies widely by industry.

The petroleum and coal industry faces the highest effective tax rate on foreign earned income at 36.1 percent, with a reported $42.7 billion in taxes paid on $118.2 billion in taxable incomeTaxable income is the amount of income subject to tax, after deductions and exemptions. For both individuals and corporations, taxable income differs from—and is less than—gross income. . The mining industry has the second highest effective tax rate at 35.3 percent.

The industry with the lowest effective tax rate was agriculture, forestry, fishing and hunting at a 5.5 percent. (One possible explanation for this rate is that income earned by activities such as fishing may not be allocable to a specific foreign country and is subject to the U.S. tax instead.)

Industries such as the finance industry (19.1 percent), wholesale and retail trade (24.4 percent), and manufacturing (28.1 percent) all hover around the 20s (more below chart).

There are multiple potential factors in the wide differentiation in effective rates between industries (e.g. different rules for different industries), but a driving factor is where a corporation locates.

Tax rates vary between different countries. If we look at just the OECD, where US corporations do much of their international business, we see a range between Ireland with a 12.5 percent rate and the U.S. with the highest rate at 39.1 percent. The OECD average sits about 25 percent and the weighted average at about 28 percent with the effective rate right in between.

An industry that relies predominately on labor and advanced technology may choose to operate in a country with a low tax rate (e.g. finance and information), where as a company that relies on the presence of natural resources must go where the natural resources are, even if they will face tax rates that are exceedingly high (e.g. petroleum, coal, and mining). Additionally, industries such as services and utilities rely directly on customer interaction and thus must go where the customers are.

But it's important to remember that this effective tax rate is not final. Due to the worldwide corporate tax system in the U.S. corporations will be required to pay additional tax on the money up to the 35 percent federal rate in the U.S. The U.S. is only one of six OECD countries with this type of system.

For example, if a U.S. company operated in Ireland and earned $100, they would pay $12.50 due to the Irish tax rate of 12.5 percent. Then when they return that money to the U.S. they have to pay additional tax based on the difference between the U.S. and Irish rate. So in this case, they U.S. corporation would pay $12.50 to Ireland and $22.50 to the U.S. for a total tax bill of $35.

On the other hand, if an English company also worked in Ireland, they would only pay once and at the 12.5 percent rate. This double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. puts U.S. companies at a competitive disadvantage.

But the bottom line is, if our worldwide system is born out of the fear that U.S. corporations don't pay taxes overseas, the data clearly shows that is not the case and in some instances, corporations must pay an equally high rate abroad.

Read more about how much corporations pay in foreign taxes on foreign earned income here. To see this data in our interactive map, see here.

Share