Taxing wealthy individuals and corporations while improving taxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. enforcement is one of the main themes in the Biden administration’s tax agenda, but raising the corporate tax rate to 28 percent (as in the American Jobs Plan) complicates enforcement efforts by encouraging businesses to form as pass-through firms that tend to have lower rates of tax compliance.

The tax gapThe tax gap is the difference between taxes legally owed and taxes collected. The gross tax gap in the U.S. accounts for at least 1 billion in lost revenue each year, according to the latest estimate by the IRS (2011 to 2013), suggesting a voluntary taxpayer compliance rate of 83.6 percent. The net tax gap is calculated by subtracting late tax collections from the gross tax gap: from 2011 to 2013, the average net gap was around 1 billion. is the difference between the amount of taxes legally owed and the amount actually paid. Most estimates of the tax gap suggest that it is about 15 percent of the amount legally owed. An IRS analysis of data from 2011 to 2013 found that the net tax gap was $381 billion. A more recent study, from economists Natasha Sarin and Larry Summers, estimated that the tax gap in 2020 was around $630 billion, after adjusting for income growth and inflationInflation is when the general price of goods and services increases across the economy, reducing the purchasing power of a currency and the value of certain assets. The same paycheck covers less goods, services, and bills. It is sometimes referred to as a “hidden tax,” as it leaves taxpayers less well-off due to higher costs and “bracket creep,” while increasing the government’s spending power. .

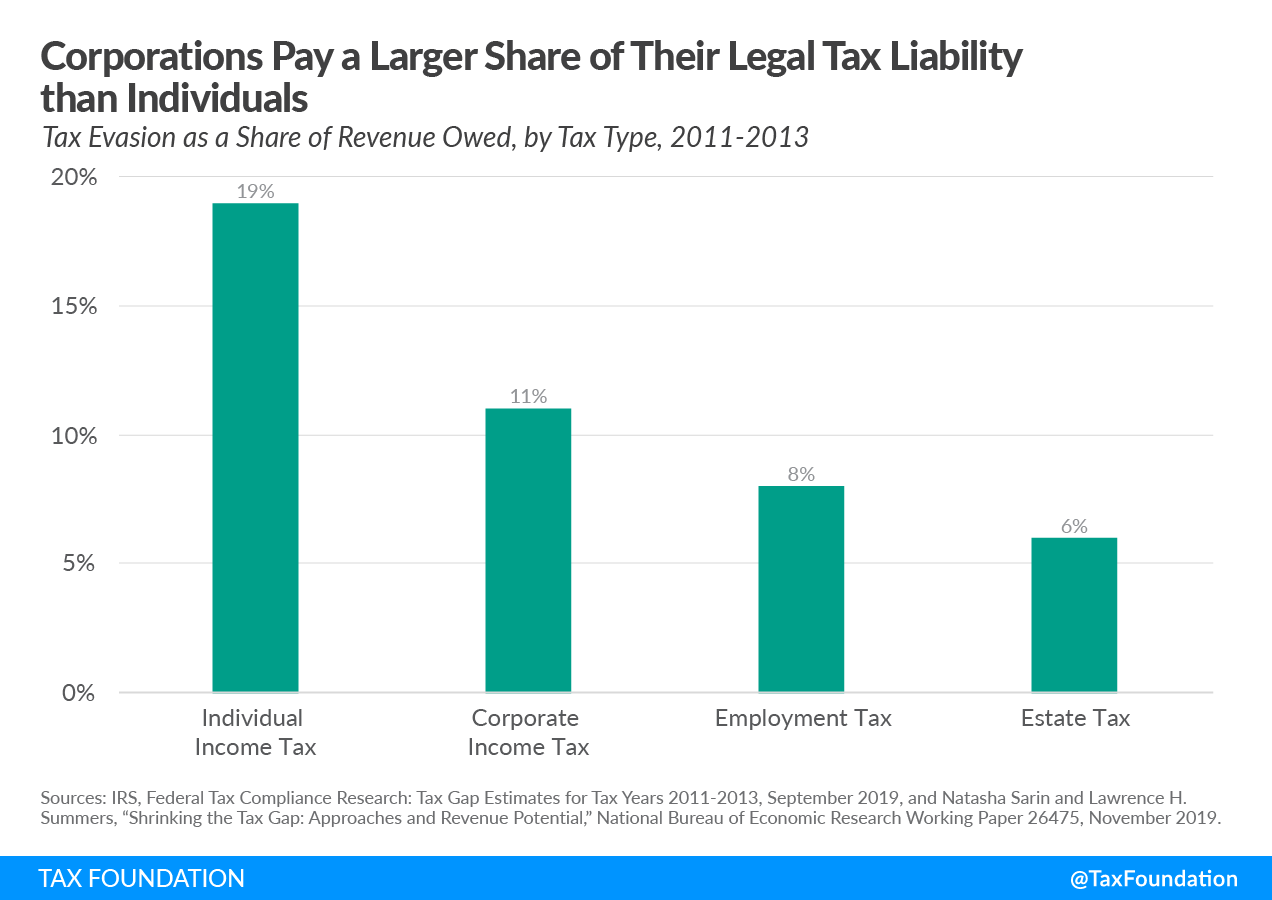

It’s important to understand the sources of the tax gap when considering how to improve tax enforcement. There’s a popular misconception that corporations are the main perpetrators of tax evasion in the United States. In reality, compliance with the corporate income taxA corporate income tax (CIT) is levied by federal and state governments on business profits. Many companies are not subject to the CIT because they are taxed as pass-through businesses, with income reportable under the individual income tax. is relatively high: according to the IRS’s analysis, the gap between taxes owed and taxes paid for the corporate income tax was 11 percent, lower than the overall tax gap of 15 percent.

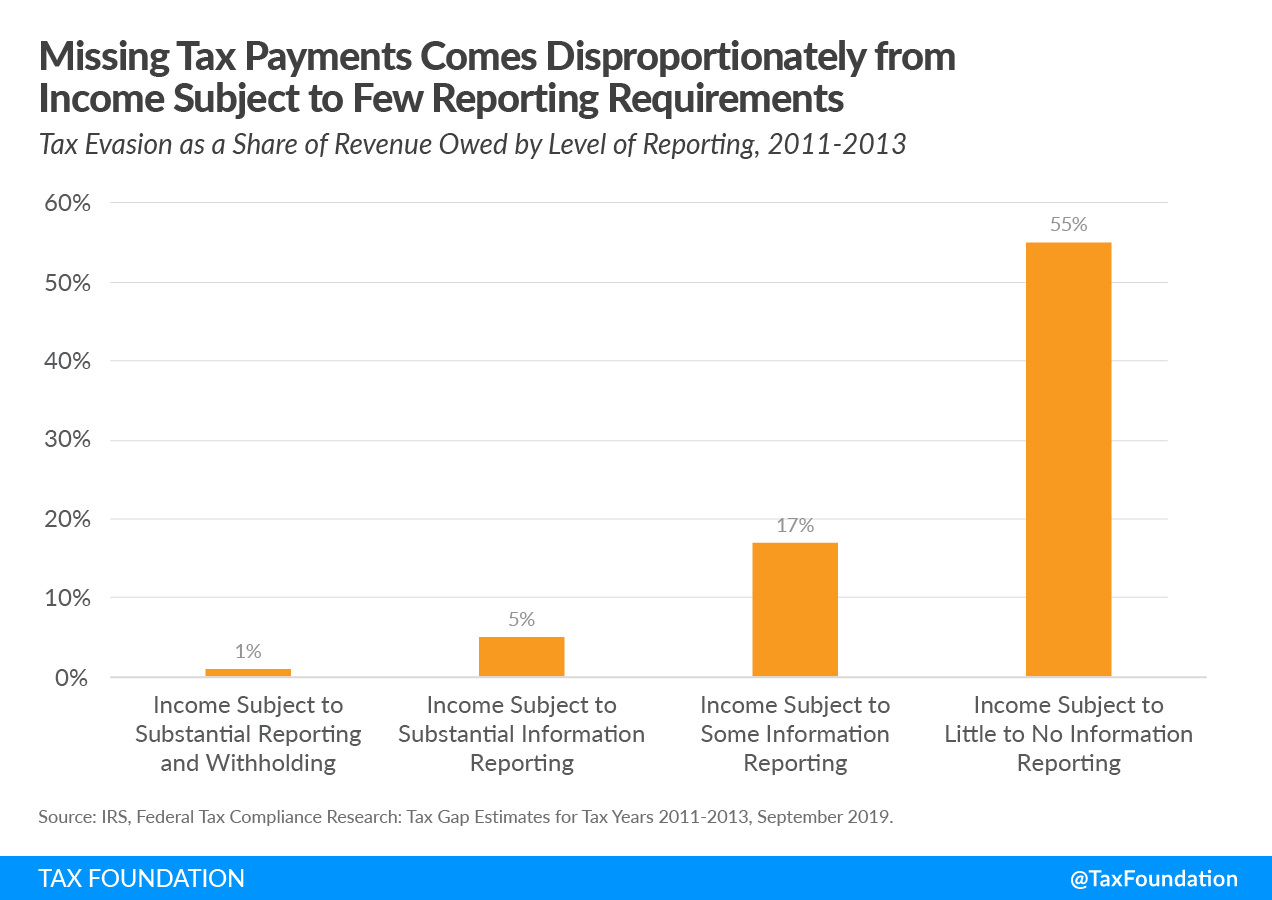

Instead, the tax with the highest evasion rates is the individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. . And income tax evasion mostly occurs on income subject to few reporting requirements. That includes many forms of business income, particularly income earned through pass-through businesses.

Pass-throughs have grown dramatically as a share of U.S. businesses since 1980. As tax experts Donald Schneider and Kyle Pomerleau wrote recently for Bloomberg Tax, the main reason the U.S. has had comparatively low corporate tax revenue as a share of GDP is that more businesses in the U.S. are constructed as pass-throughs.

One of the reasons why the U.S. has a high share of pass-through firms is corporate tax policy. For a long time, the U.S. had a 35 percent corporate tax rate. That, coupled with the double taxationDouble taxation is when taxes are paid twice on the same dollar of income, regardless of whether that’s corporate or individual income. of corporate income (through corporate profits and dividends) meant that noncorporate investment received better tax treatment than corporate investment did. As a result, businesses were less likely to take a corporate structure.

By favoring noncorporate activity over corporate activity, the tax code incentivized businesses to adopt pass-through structures, where the tax gap is larger.

By lowering the corporate rate to 21 percent, the Tax Cuts and Jobs Act (TCJA) of 2017 helped reduce these incentives. The TCJA also introduced a new provision for pass-through businesses, Section 199A, allowing people to deduct up to 20 percent of income from pass-throughs. Nonetheless, the net impact of the TCJA was to shrink the tax bias between corporate and noncorporate income.

Unfortunately, the Biden proposal would reverse these improvements. Raising the corporate rate to 28 percent would make forming a business as a pass-through more advantageous than as a C corporation. Additionally, higher tax rates generally increase the incentives for firms and individuals to engage in tax evasion. Under a higher rate, the return for each dollar of income not reported is higher.

Tax reform should be about creating a simpler and more pro-growth tax code, especially given that simpler tax codes tend to be easier to enforce. If Biden wants to reduce tax evasion, raising the corporate rate, increasing the incentives to engage in tax evasion, and creating a larger tax advantage to becoming a pass-through businessA pass-through business is a sole proprietorship, partnership, or S corporation that is not subject to the corporate income tax; instead, this business reports its income on the individual income tax returns of the owners and is taxed at individual income tax rates. is counterproductive.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

Subscribe