As the House of Representatives this week considers a bill that would make the individual reforms of the TaxA tax is a mandatory payment or charge collected by local, state, and national governments from individuals or businesses to cover the costs of general government services, goods, and activities. Cuts and Jobs Act (TCJA) permanent, one important change to keep in mind is the increased standard deductionThe standard deduction reduces a taxpayer’s taxable income by a set amount determined by the government. It was nearly doubled for all classes of filers by the 2017 Tax Cuts and Jobs Act (TCJA) as an incentive for taxpayers not to itemize deductions when filing their federal income taxes. . The TCJA lowered individual income tax rates, and nearly doubled the standard deduction. Now, nearly 29 million more households will be better off taking the standard deduction instead of itemizing deductions, meaning they will have a much simpler tax filing process.

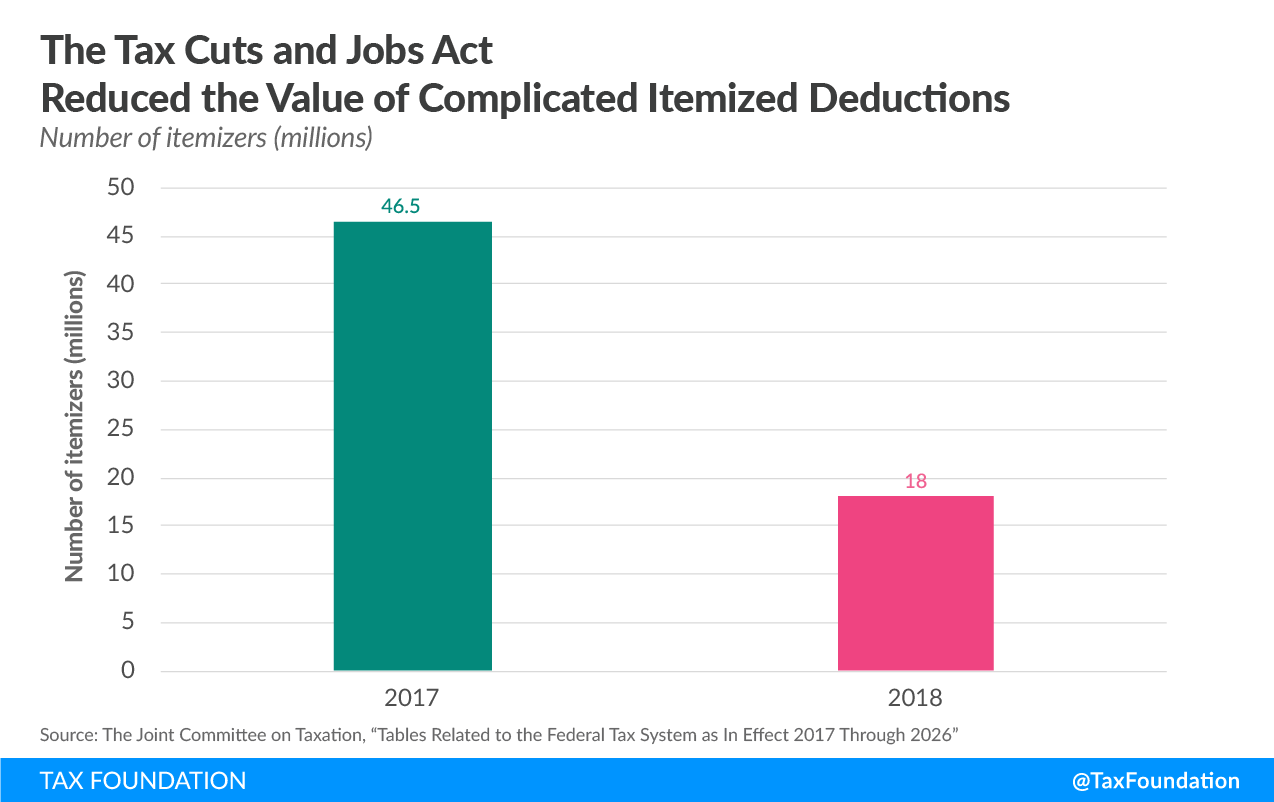

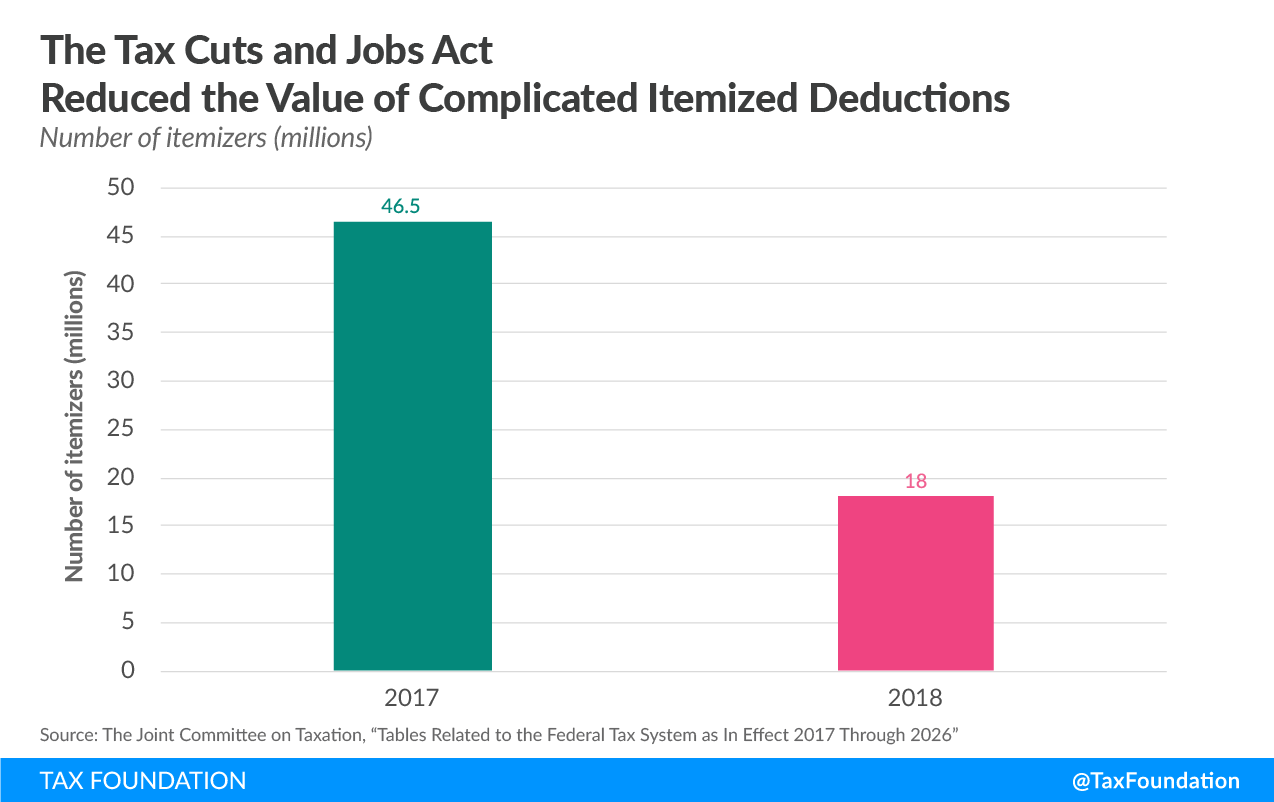

The Tax Cuts and Jobs Act increased the standard deduction from $6,500 to $12,000 for single filers and $13,000 to $24,000 for taxpayers who are married filing jointly. Thus, millions of households will no longer need to go through the complex process of itemizing their deductions. The Joint Committee on Taxation estimates that the number of filers who itemize will fall from 46.5 million in 2017 to just over 18 million in 2018, meaning that about 88 percent of the 150 million households that file taxes will take the increased standard deduction.

Stay informed on the tax policies impacting you.

Subscribe to get insights from our trusted experts delivered straight to your inbox.

SubscribeRecall that when households file their individual income taxes, they have two options for deductions. They can either claim the standard deduction, or they can forgo the standard deduction and deduct a wide range of expenses instead. These itemized deductions include expenses such as mortgage interest payments and charitable donations. The process of deciding whether to itemize is complex; it requires maintaining records of various expenses, determining which can be deducted according to Internal Revenue Service (IRS) rules, and weighing whether all the deductions add up to more than the standard deduction.

To understand why a bigger standard deduction is a simplification, consider a married couple who under previous law would have taken $14,000 in various itemized deductionItemized deductions allow individuals to subtract designated expenses from their taxable income and can be claimed in lieu of the standard deduction. Itemized deductions include those for state and local taxes, charitable contributions, and mortgage interest. An estimated 13.7 percent of filers itemized in 2019, most being high-income taxpayers. s. Now, under the Tax Cuts and Jobs Act, it would be more advantageous for this couple to take the standard deduction of $24,000, as it allows them to deduct an extra $10,000 and eliminates the need to spend time and energy collecting receipts and completing Schedule A of Form 1040.

Given all the changes the TCJA made, the IRS estimates the average time to complete an individual income taxAn individual income tax (or personal income tax) is levied on the wages, salaries, investments, or other forms of income an individual or household earns. The U.S. imposes a progressive income tax where rates increase with income. The Federal Income Tax was established in 1913 with the ratification of the 16th Amendment. Though barely 100 years old, individual income taxes are the largest source of tax revenue in the U.S. return will fall by 4 to 7 percent. Using this, we estimate the TCJA will result in compliance savings ranging from $3.1 billion to $5.4 billion as individuals spend fewer hours complying with the tax code.

However, these simplifications and other individual income tax changes are scheduled to expire after 2025. That is why the House of Representatives is considering a series of bills that would make these individual income tax changes permanent and further improve other areas of the tax code.

For more about how the Tax Cuts and Jobs Act simplified the individual income tax code, see our new paper.

Share